According to a study by MGI Research, nearly half of organizations (42%) experience some form of revenue leakage.

We’ve seen this ourselves; posing as a real prospect, a member of our team submitted demo requests for 114 B2B organizations to see how quickly they’d respond. Most organizations took several hours to get back to us—if they even responded at all.

Given how pervasive revenue leakage is, there’s a good chance that your organization is, unfortunately, experiencing it to some extent.

To help you identify, prevent, and address it, we’ll review what it is, how it’s caused, and a few automations that solve for it.

Ready to address revenue leakage?

Workato, the leader in enterprise automation, lets your team build automations that can block any leak.

What is revenue leakage?

It’s the potential revenue your business could receive, but for whatever reason doesn’t come in. Given this broad definition, revenue leakage can take different forms, depending on the department you look at.

Related: What is customer success automation? (5 examples)

The causes of revenue leakage

Here are just a few sources of revenue leakage.

Failing to make intent data actionable

Prospects that view your competitors’ pages on a 3rd-party review site (e.g. G2) are often warm leads that can be converted relatively easily if nurtured promptly and strategically. Unfortunately, without a built-out automation (which we’ll cover in the following section), identifying and engaging with these leads quickly can be extremely challenging.

Poorly-managed deal cycles

Your customer-facing employees likely have to follow certain steps when nurturing leads and managing clients. For instance, based on the sales process your organization establishes, your reps should gather certain pieces of information on a lead within a given time frame.

Failing to meet whatever processes your GTM teams set can ultimately lead to wasted time; your customer-facing employees might focus too much on prospects or clients that were never going to close or renew—and not enough on more lucrative and promising opportunities.

Losing existing customers

Customer churn is, clearly, the most concrete form of revenue leakage, as it’s revenue that your business loses. The reasons behind churn, however, can be nuanced, which explains why organizations often attach health scores to accounts that consider a number of factors.

Unfortunately, like intent data, these health scores in and of themselves won’t prevent revenue leakage; you’ll need to make the scores easily accessible to and actionable for the appropriate team members.

Gaps in the quote-to-cash process

Once you close an opportunity and are ready to invoice the newly-minted client, a few issues can take place. For instance, finance, for some reason, might not become aware of the client, and as a result, they don’t deliver the invoice; alternatively, if the data sync between, say, your CRM and ERP system isn’t working properly, finance might end up sending the client an inaccurate or incomplete invoice.

Whatever the invoicing issue, the outcome is consistent: you’re unable to collect the revenue you’ve earned in full, on time.

Related: A guide to integrating your ERP system and CRM

How to prevent and stop revenue leakage

Now that you know what revenue leakage is and the various forms it can take, let’s explore some automations that can help minimize it at your organization.

Share intent data in near real-time and make it easy to act on

To help your reps prioritize the leads they pursue and use compelling messages in their outreach, you can activate prospects’ intent data with automation.

Here’s an example that our sales team uses:

1. Once a lead views a competitor’s page in a software review site like G2, the workflow gets triggered.

2. A platform bot (e.g. “Buyer Intent Bot”) notifies the assigned rep of that activity via a message in your business communications platform (e.g. Slack).

3. Through the message, the rep can learn more about the opportunity, and they can go on to visit the opportunity’s page in your CRM with the click of a button, where they can add the contact(s) to the appropriate nurture sequence.

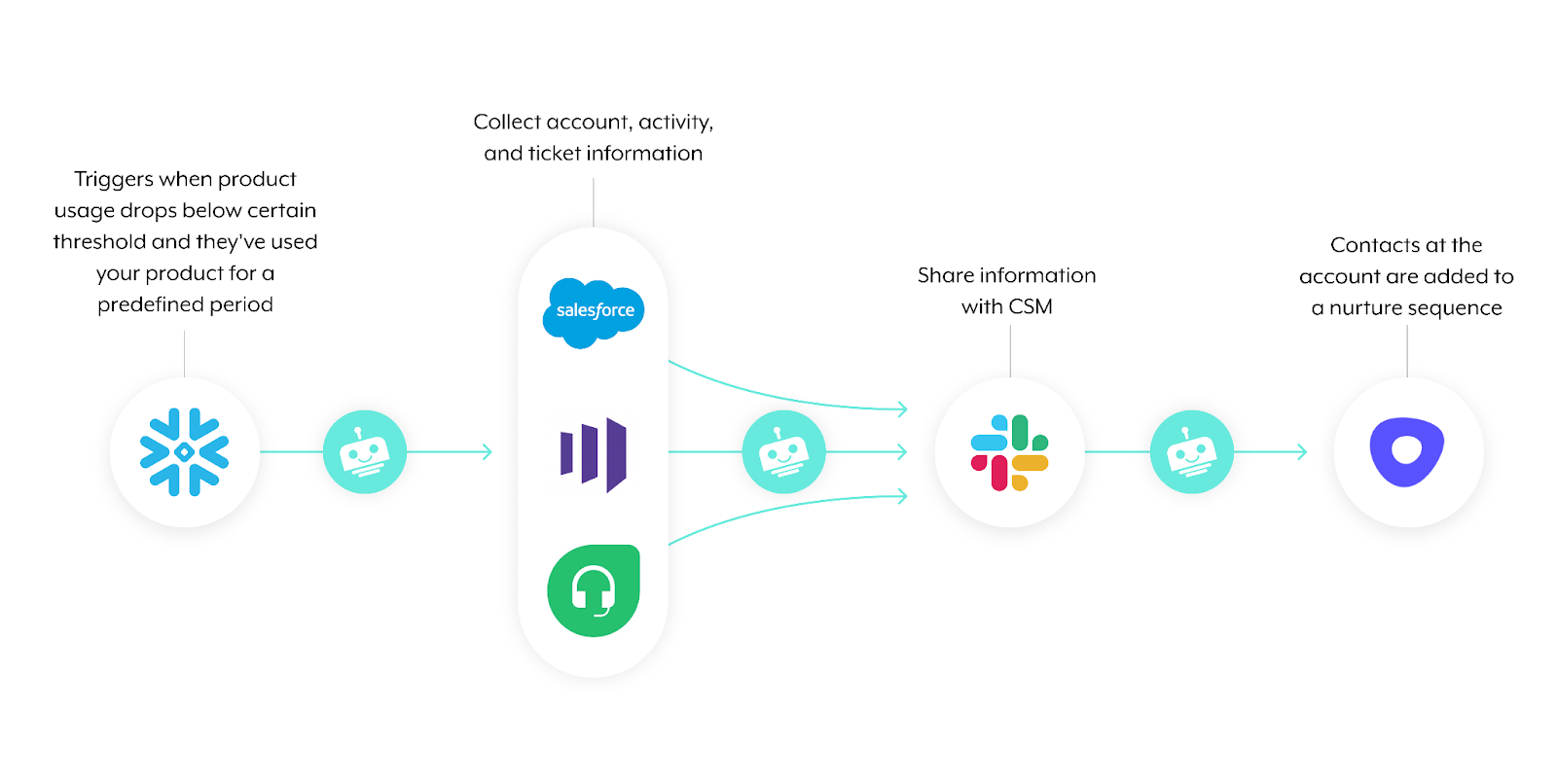

Proactively identify and engage with clients who are at risk of churning

Your business likely uses certain criteria to flag accounts that are at risk of churning. For example, a company that’s invested in a specific subscription should be using your product at a certain level at a given point in time. Anything that falls short of this expectation signals that they’re a churn risk.

To help your customer success managers (CSMs) identify and respond to such accounts, you can build an automation that’s triggered off of the criteria your organization uses to define an account that’s high-risk.

Here’s how it can work:

1. Once the client’s product usage drops below a certain threshold and they’ve used your product for a predefined period, the workflow gets triggered.

2. A platform bot messages the employee (via your business communications platform) that the account is at risk of churning; within its message, it provides additional information on the account from your other applications.

3. The CSM can take prescriptive actions inside the message, all but guaranteeing that they’ll respond quickly and effectively. For example, with the click of a button, they can add contacts at the account to a specific email sequence in an application like Outreach that’s geared towards educating users on different facets of your product.

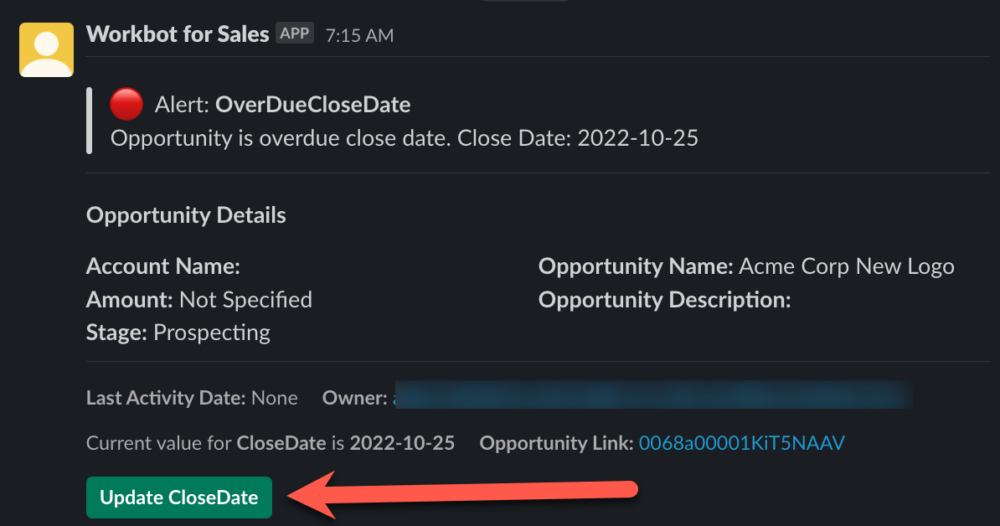

Keep pipeline data up to date

The majority of your reps are likely not keeping their opportunities updated over time. This leaves their managers poorly positioned to identify the accounts they can coach them on and help them close—while ignoring those that aren’t worth their time.

To help your reps stay on top of their pipeline—without having their managers constantly nag them to update various fields—, you can build an automation that asks reps to update specific opportunities as soon as it’s needed.

For example, once an opportunity’s close date passes, the assigned rep can receive a message from a platform bot (e.g., “Workbot for Sales”) in their business comms platform. The message could include details on the opportunity to help refresh their memory on the account and to help them decide how they should update it. The rep can then edit the close date within the message with a simple click of a button.

To ensure that the rep updates the opportunity quickly, the platform bot can send this notification every day for a certain stretch of time. And if they still don’t update it after a certain number of reminders, their manager can get notified via the platform bot—prompting the manager to ask their rep to update the opportunity.

The hope is that this automation will eventually not be needed for a given rep. Their initial experiences with these reminders should help motivate them to be more proactive with their accounts and manage their forecasts more diligently.

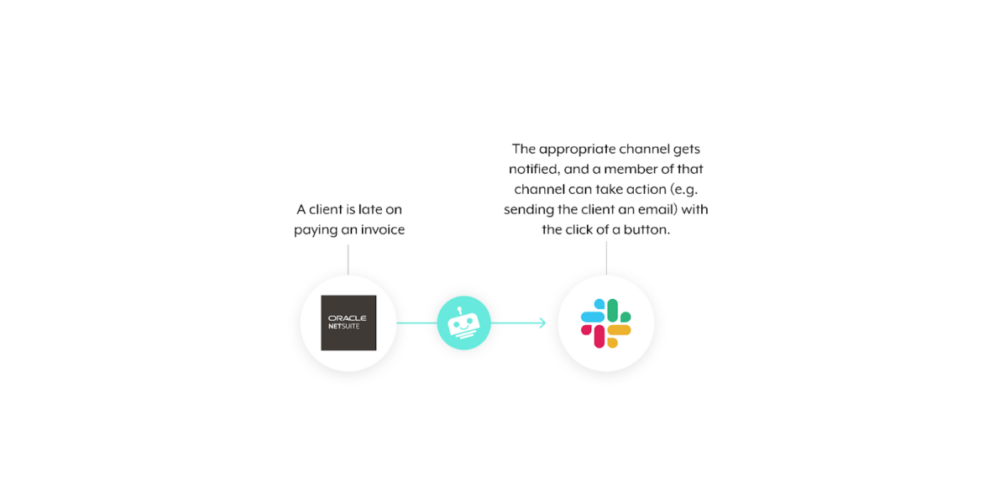

Surface unpaid invoices to finance as soon as they’re overdue

Like sales pipeline, managing invoices manually can quickly become overwhelming. Your finance team might have trouble generating and sending them on time, identifying any errors in them, keeping tabs on any that are overdue, etc.

You can take some of this tedious work off their plate and prevent revenue leakage by turning to automation.

For instance, in the case of surfacing and addressing overdue invoices, you can build an automation where once an invoice becomes overdue, a platform bot messages a specific channel in your business communications platform that includes all of the relevant members of your finance team. Within the message, they can learn more about the client and the invoice, and with the click of a button, they can act—such as sending an email to a contact at that account that reminds them to pay off the invoice.

Plug any revenue leak with Workato

Workato, the leader in enterprise automation, can help you implement any of the use cases highlighted above—among countless others—to address revenue leakage. We also offer:

- Workbot®, a customizable platform bot that lets you bring your automations to your business communications platform, whether that’s Slack, Microsoft Teams, or Workplace from Meta

- A Sales Process & Forecasting Alignment Accelerator, which provides the automation templates, connectors, guides, and other resources you need to quickly implement an automated solution for achieving pipeline resilience

- A low-code/no-code UI and enterprise-grade security and governance so that your GTM teams can implement high-performing automations easily and safely

Revenue leakage FAQ

In case you still have any questions on revenue leakage, we’ve answered a few more below.

Why is revenue leakage important?

As mentioned earlier, a significant share of organizations experience revenue leakage, and for those that do, its impact can be significant. According to Ernst & Young, anywhere from 1 to 5% of an organization’s EBITDA (earnings before interest, taxes, depreciation, and amortization) leaks, which can translate to millions, if not billions, of dollars. Moreover, if left unresolved, revenue leakage is likely to persist.

How do you calculate revenue leakage?

Its calculation can vary by team, organization, industry, among other factors, so it’s hard to provide a single, definitive calculation. That said, a CS team might measure it by customer churn; sales might measure it by close rates; and finance might measure it by unpaid or underpaid invoices.