Finance & Accounting is now the most automated business function.

When analyzing the automations that 900 of our clients built last year as part of our Work Automation Index, we found that 26% of an organization’s automations, on average, fall under finance; this trumps IT’s share, the runner up, by a full percentage point.

This insight only scratches the surface. You can read on to discover additional finance automation statistics that showcase how the department is approaching automation to tackle their challenges.

See how every department leverages automation

You can access our Work Automation Index to see how HR, sales, marketing, customer support, and IT also tackle automation.

Automating returns and refunds has ballooned by 335% YoY

As the pandemic pushed companies to rely on their online business, they’ve been motivated to improve the online shopping experience in a variety of ways.

Automation is increasingly relied upon to deliver on this aim. Case in point: Returns and refunds have seen a greater rise in automation adoption than any other process we measured.

While the specific approaches that organizations can take in automating these processes inherently differ, the benefits they bring to both clients and your business are more or less the same: Clients can return items more easily and receive refunds sooner, while your employees can make less mistakes and spend less time on processing the returns.

Related: 3 IT automation trends (based on our Work Automation Index)

Order to cash accounts for 57% of finance automations

Since your order-to-cash process determines how long it takes clients to receive your product and your business to recognize revenue, it’s paramount that the process operates as smoothly as possible.

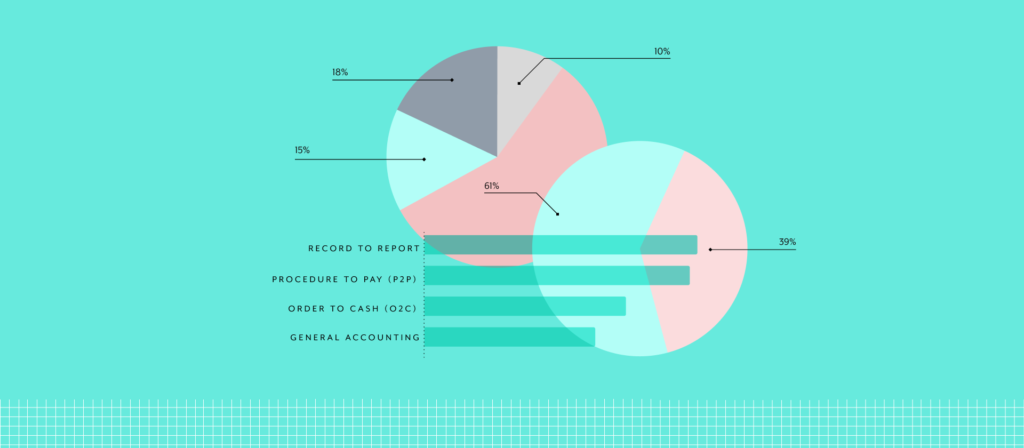

Perhaps it’s little surprise then that O2C is the most frequently automated process in finance, owning a 57% share of the function’s automations.

When comparing the data year-over-year, however, another trend emerges: The share of automations for O2C was 73% last year, leading its share to drop by 16 percentage points in just a year.

We believe this decline is closely tied to the automation maturity of finance departments; last year, finance teams were more likely looking to automate core processes, like O2C, in order to maximize the impact of their automations. With that now out of the way for many, they’re focusing their attention on automating additional financial processes, like procure to pay and record to report.

The data supports this idea, as both record to report and procure to pay have seen a bigger spike in automation adoption over the past year than O2C.

While the benefits of automating these additional workflows may not carry the same punch as automating O2C, the returns are still significant.

An automated P2P process allows employees to request the equipment and devices they need more easily. At the same time, it gives managers and IT a more straightforward way to review, approve (or reject), and fulfill these requests.

Related: How an automated P2P process can work

An automated record-to-report process, meanwhile, allows finance teams to streamline the entire process, from collecting data to validating it to generating reports for various stakeholders. This leads to more accurate, comprehensive, and timely reports, which, in turn, allows management to make more informed and strategic decisions.

Finance professionals are building 39% of their department’s automations

The rise of low-code/no-code solutions like Workato means that IT no longer has to build and maintain all of the automations themselves. We’re already seeing this play out, as nearly 2 in 5 finance automations are now built by employees within the department.

The trend should be celebrated. It means that employees in finance are leveraging their unrivaled expertise in specific finance applications, data, and processes to build more powerful automations. In addition, IT now has more time to dedicate towards other business-critical initiatives, including assisting with more complex finance automation projects.

Finally, we believe that the 39% share of business users involved in implementing finance automations will only increase in the years ahead. In response, IT will continue its shift towards being an enabler for builders.

You can learn about the automation trends we uncovered in other departments, like HR, sales, marketing, and IT, by reading through our Work Automation Index.