Note: J.Alan Goddard, a Director at Connor Group, also contributed to this article.

A high-performing order to cash process benefits your business in all sorts of ways.

It allows for a frictionless experience for clients and employees; it improves your cash flow; it enables billing and revenue recognition to operate seamlessly—and a whole lot more.

These benefits point to why so many organizations are looking to optimize their process.

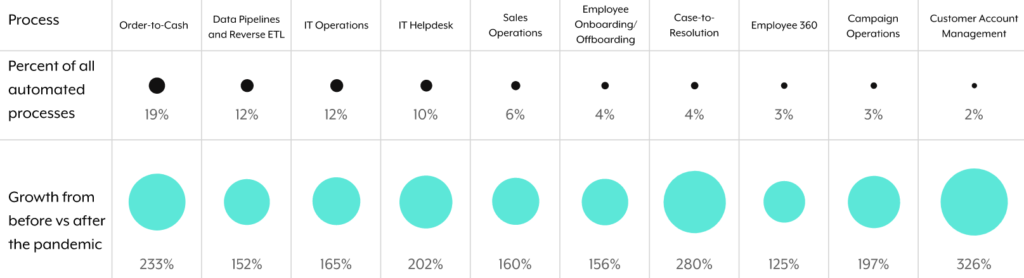

How do we know? The team at Workato analyzed the automations that hundreds of their clients have implemented over the past year and found that order to cash (O2C) was the most automated process; furthermore, the process has seen a 233% spike in automation adoption.

This might leave you wondering how your team should leverage automation across your own order to cash process.

While the question is simple, the answer is more nuanced: It depends on where you are in your automation journey.

We’ll explore each level in this journey so that you can identify the automations that make the most sense for your team, but before we do, let’s align on the definition of order to cash.

Looking for a deep dive?

Our whitepaper breaks down each stage of the O2C maturity roadmap in detail.

What is order to cash?

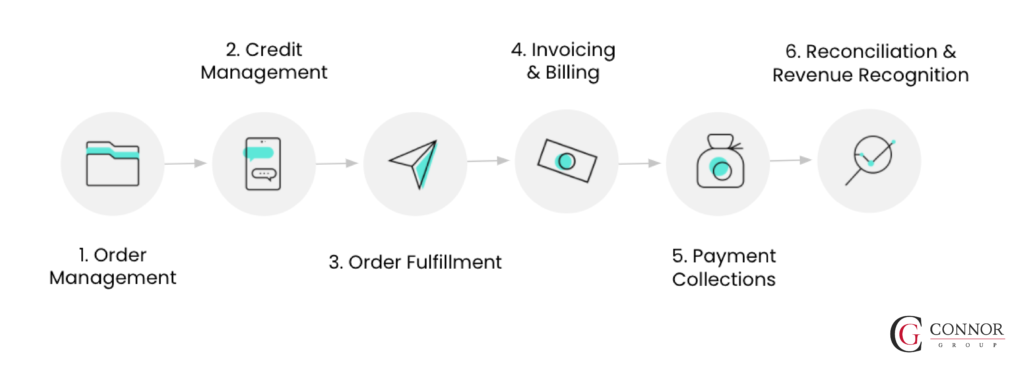

Order to cash, which also goes by O2C, otc, order to cash process, and order to cash cycle, is an organization’s end-to-end order processing system. This business process includes everything from invoicing the new client to performing reconciliation and revenue recognition.

Here’s more on each of these steps:

Note: These steps can look different at any organization, as they’re influenced by your business model, tech stack, data architecture, among other factors.

1. Order management: Once the customer order is added to your order management system or ERP, the appropriate parties get notified and can work toward fulfilling it.

2. Credit management: Clients who qualify to receive credit go through a specific approval process; they can be denied or approved automatically, but more complicated scenarios may require an employee in finance to get involved directly.

3. Order fulfillment: Your fulfillment team delivers your product; all the while, the inventory in your reps’ CRM gets updated—preventing them from selling more of a product that’s unavailable.

4. Invoicing and billing: The client receives the invoice, which reflects the terms agreed upon in their order.

5. Payment collections: Your organization’s accounts receivable team receives the payment, whether it was delivered online or offline.

6. Reconciliation & revenue recognition: As soon as you deliver your product or service, you can begin to recognize revenue.

Note: These processes are highly dependent on each other, meaning that if a bottleneck arises in one step, others can be negatively impacted.

With this refresher in mind, let’s explore the extent to which automation can transform your O2C cycle by walking through 4 levels.

Related: 3 common sales order automations

Level 0: Minimal integrations and no automations

At this stage, most of your processes run manually.

Your employees are forced to carefully review and make sense of contracts, notes in apps, relevant emails, etc. and then work to ensure that all of this information is accounted for in their ERP system. Only then, they’re ready to bill customers and perform revenue recognition (both of which are also performed manually).

This level calls for inefficient activities from employees, such as app hopping and data entry, which not only wastes their time but also leaves them prone to making significant errors. Moreover, for the few integrations you’ve managed to build, they’re likely point-to-point. This means your engineering team has to play a big role in implementing and maintaining them via custom code.

Level 1: Simple tasks are automated

Now you’re starting to integrate systems with an integration platform as a service (iPaaS) in order to keep data in sync. This eliminates employees’ need to perform extensive app hopping and data entry—but there’s still issues to contend with. Namely, many of your processes still lack automation.

For instance, your team might need to manually enrich a product record in the ERP system as additional data is required to bill from the system or perform revenue recognition; in addition, your finance team might be communicating with sales or with customers, via email or phone, to discuss topics like billing status.

Related: A guide to integrating with your ERP system

Level 2: Process and data flows are automated

This level invites a wealth of automation use cases, where process flows—like making approvals, providing alerts, and sending reminders—are now streamlined, and data sets across various source systems are being transformed, enriched, aligned, and validated.

Below, we’ll break down how the latter can work in the context of an e-commerce business that uses a self-service model. We’ll also assume that the business’ source systems employ a diversity of data models, each with its own level of complexity.

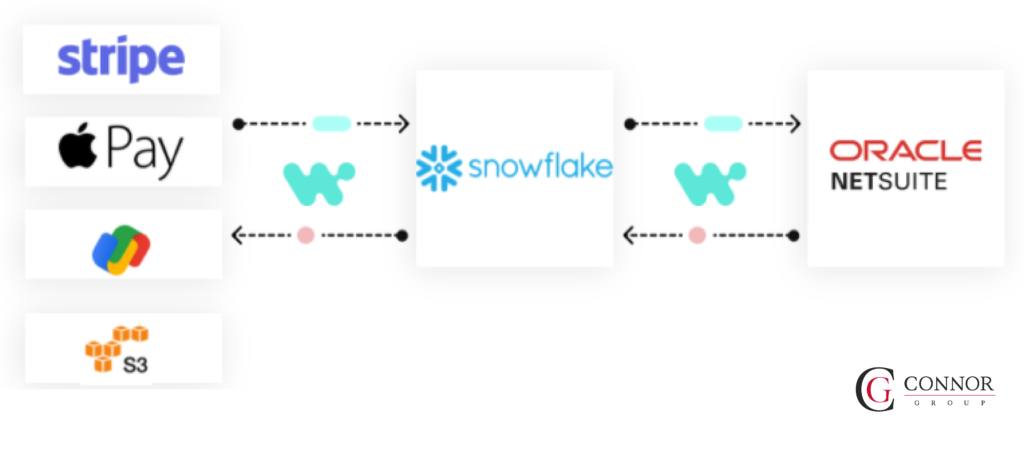

Using an integration-led automation platform, you gather the data from each source system—this includes the data from your app store, payment providers, and subscription system. All of this data is then added into a data warehouse, like Snowflake, where the integration-led automation platform transforms it into a single, common data model.

The data is then aggregated and recorded into your ERP system, which can take the form of journal entries, orders, invoices, etc. The goal behind this is to automate both billing transactions and revenue recognition.

Finally, you’re then able to use the integration-led automation platform to reconcile the sales to cash.

Level 3: Decision making is automated

In addition to moving data and streamlining workflows, this level lets you proactively manage the entire process. This includes using advanced technologies, like AI, machine learning, and natural language processing, to provide proactive alerting and insights to key metrics.

Let’s take a closer look at how this can work in practice:

Using an integration-led automation platform, you connect your CRM and ERP and then build automated workflows around approvals, project creation, and revenue recognition. In addition, data is synced between both systems and is moving through to the apps your employees are already working in—such as a business communications platform, like Slack. Within the business communications platform, your employees can also access the data and actions from your CRM or ERP, allowing them to work more efficiently.

Moreover, your data analytics systems store the order to cash data and—leveraging an integration-led automation platform—can start triggering actions based on the events that take place. Here are just a few examples:

- When a sales is made to a customer with a bad credit history, a credit approval step gets added in real time before the deal can move to closed won

- When a payment isn’t received by its due date, an automated notification goes out to either the sales person or the customer (or both)

- When discounts rise above expected ranges, sales or finance leaders get alerted in real time and can take action

- When a sales rep is managing a prospect at a certain stage in the sales cycle, they can receive a pricing recommendation that helps them close the sale

Related: 3 order automations worth implementing

Final thoughts

Before investing in initiatives that can move your business up these levels, take the time to assess where your O2C process currently stands.

This requires finding the answers to questions like:

- What percentage of my use cases are integrated?

- What percentage of my workflows are automated?

- Is technology a key component of ensuring we have good data?

- Do we have accessible and dynamic data that provides proactive insights?

With these answers on hand, you can set the appropriate goals for maturing your order to cash process and work towards meeting them.

About Connor Group

Connor Group is a specialized professional services firm of Big 4 alumni and industry executives. Our team of highly experienced professionals helps financial executives with their most complex and significant matters, including financial accounting and operations, IPO and M&A services, digital solutions, and managed services. Our clients are the world’s top growth companies and we support them as they change the world and create new markets!

Our client portfolio includes multi-billion-dollar public, mid-cap public, and pre-IPO companies ranging from early stage to late stage. Our global clients represent the most exciting industries including high tech, Internet, social networking, gaming, software, ad tech, cleantech, life sciences, financial services, consumer products, biotech, services, and manufacturing.

Our goal at Connor Group is to be the most respected firm across our service lines by delivering the highest quality services to our clients. We are hired by finance and accounting executives who understand the importance of leveraging their time as well as having a partner that can successfully execute their needs.