No organization is immune to receiving late payments.

In the case of medium-sized organizations, more than 1 in 4 of their payments arrive late; while more than 1 in 10 come in late for SMEs.

To hold clients accountable and to empower them to pay off each invoice on time and by the full amount, you can perform a variety of automations around your invoicing process.

We’ll walk through a few invoicing automations that can help mitigate late payments and improve other aspects of your invoicing workflow. But before we do, let’s align on what we mean by automated invoicing.

An introduction to the O2C maturity model

Learn the ins and outs of the model so that you can reassess and improve your own process.

What is automated invoicing?

Automated invoicing is the use of automation to streamline any process in your invoicing workflow. This includes tasks like creating the invoice, scheduling its delivery, identifying errors, and processing the payment in your ERP system.

To automate invoicing, you’ll need to use a platform that can “listen” to your apps for specific business events (or triggers). Once a business event occurs, the platform performs the pre-defined business outcomes (or actions) across your apps, data, and teams.

Related: A guide to automating your finance workflows

How to automate invoicing

To help make our definition more tangible, let’s walk through a few examples.

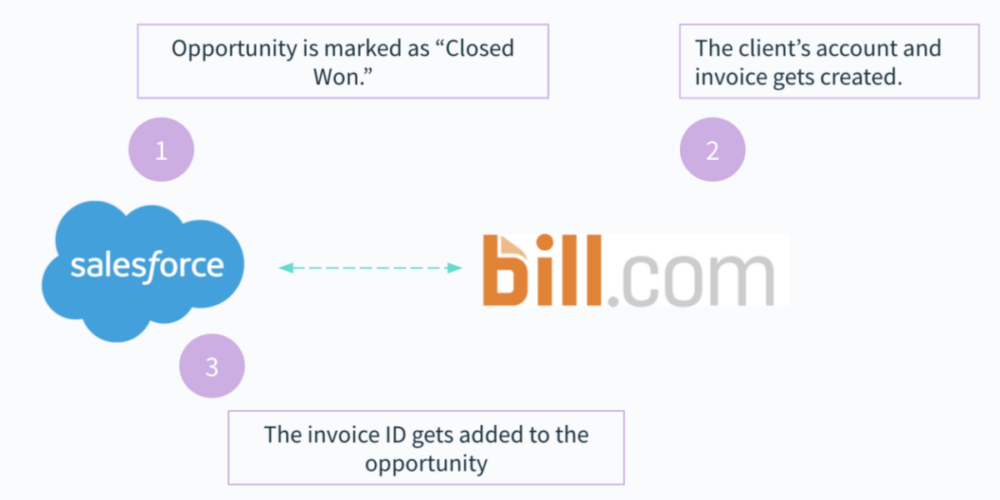

Create invoices instantly

Part of managing an efficient order-to-cash process is creating invoices as soon as orders come in. Here’s how automation can help your team do just that:

1. Once an opportunity is marked as “Closed Won” in your CRM (e.g. Salesforce), the workflow gets triggered.

2. Using the fields from the closed opportunity in your CRM, you can create and populate the client account and their invoice in your billing platform (e.g. Bill.com).

3. The invoice ID that gets created in your billing platform can get added to the closed opportunity in your CRM.

Related: How to automate your procure-to-pay process

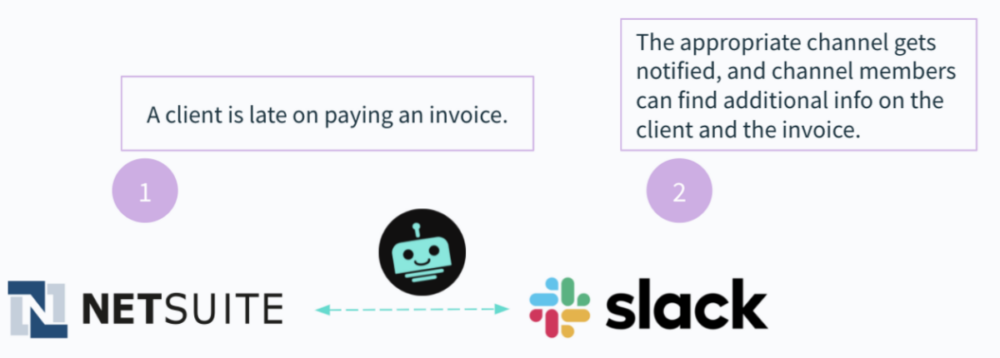

Identify and troubleshoot issues as they arise

All kinds of issues can crop up when invoicing clients.

To help your team stay on top of them and take the right steps in addressing any, you can use a chatbot that can communicate between your ERP system and your business communications platform (e.g. Slack). That way, as soon as an issue gets flagged in your ERP system, the chatbot can notify the appropriate employees in the business comms platform.

Here’s how it can work in the context of a client missing their invoice payment:

1. When a client fails to pay off an invoice on time (according to the due date in your ERP system), the workflow gets triggered.

2. A chatbot notifies the appropriate finance channel in your business communications platform, alerting them of the missed payment along with details on the invoice and the client.

Keep sales reps up to speed

Once a sales rep closes a deal, they’ll want to make sure that the transition from prospect to client runs smoothly.

As a result, they’ll likely want access to the status of the new client’s invoice—whether it’s been issued, paid, etc.—so they can take action if needed.

You can provide sales reps with this insight by integrating your billing platform with your CRM, and then setting up a workflow that keeps the invoicing data between the two in sync.

Related: Why you should automate order processing

Make changes to invoices in a way that’s convenient

Your team might need to modify an invoice for different reasons. For example, it might be to change the payment terms, or, in a more minor case, fix a spelling error.

No matter the situation, you can help your employees make any changes without leaving your business comms platform. All they’d need is a chatbot that can communicate between your business comms platform and your billing system.

More specifically, the chatbot would allow the employee to log into your billing system from your business comms platform—to ensure that they do, in fact, have editing privileges—, and then it would allow the employee to find and edit the relevant invoice.

Provide refunds with ease

If, for whatever reason, your team needs to provide a refund for a client, you can fast-track the process and make it easy on your support team by integrating your billing platform with the app your reps use to manage clients (e.g. Jira). From the latter, your reps can see how much they need to refund, and they can go ahead and issue it.

The benefits of automating invoicing

Here are just a few reasons why automating these processes are in your organization’s best interests.

- It increases your chances of receiving payments on time.

By seamlessly creating invoices and delivering them to clients quickly, your clients can have more time to pay them before they’re due. In addition, you can use an invoicing automation that alerts customer-facing employees when their accounts have yet to pay off an invoice that’s due in the near future—prompting these employees to take swift action.

Related: The benefits of automating your accounts payable processes

- It prevents costly errors from taking place.

The process of filling out an invoice manually leaves you vulnerable to human error. This can take various forms, whether your team inputs the incorrect invoice amount, due date, company name, etc. or your team sends a client the wrong invoice or a duplicate version soon after they receive the original.

Invoice automation by and large prevents issues like these from happening because it allows your team to automate manual, error prone tasks.

- It enables customer-facing employees to focus more on delivering clients value.

Now that your customer-facing employees can spend less time managing specific tasks around invoices, they can focus on other critical activities that can benefit clients and your organization. This includes anything from pursuing a potential upsell or cross-sell opportunity based on a client’s level of product usage to resolving a specific client issue faster.

- It removes data silos across your teams.

Many teams will need to keep tabs on clients’ invoices, whether it’s sales, customer support, or finance.

Invoice automation can help ensure that data is kept in sync across these teams’ apps over time—allowing for better alignment and collaboration, as well as less unnecessary work, such as entering invoice data that already exists in another app.

- It delivers an improved customer experience.

By allowing clients to receive accurate and complete invoices quickly, and by sending timely reminders to pay them off, you’re making your clients’ lives easier and showing them that they can trust your organization.

Related: The benefits that come with ERP system integration

Learn how Workato can help your team automate invoicing

Workato, the leader in integration-led automation, offers a low-code/no-code platform that allows your team to implement any of the automations outlined above, among countless others.

Learn how your team can use the platform and discover how Workbot, Workato’s enterprise chatbot, can also help automate your team’s invoicing workflows by scheduling a demo with one of our automation experts.