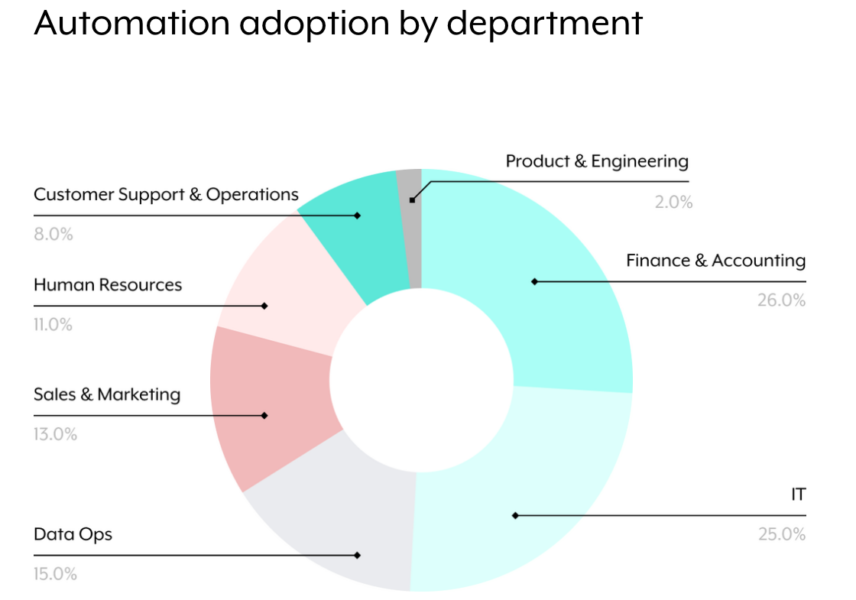

When analyzing departments that implement automations in Workato, we found that finance and accounting came out on top—making up 26% of the automations built in our platform.

The insight makes sense when you consider the types of human errors that result from performing finance-related tasks manually, from managers approving expenses that fall out of policy to accounts payable sending an invoice payment to the wrong vendor.

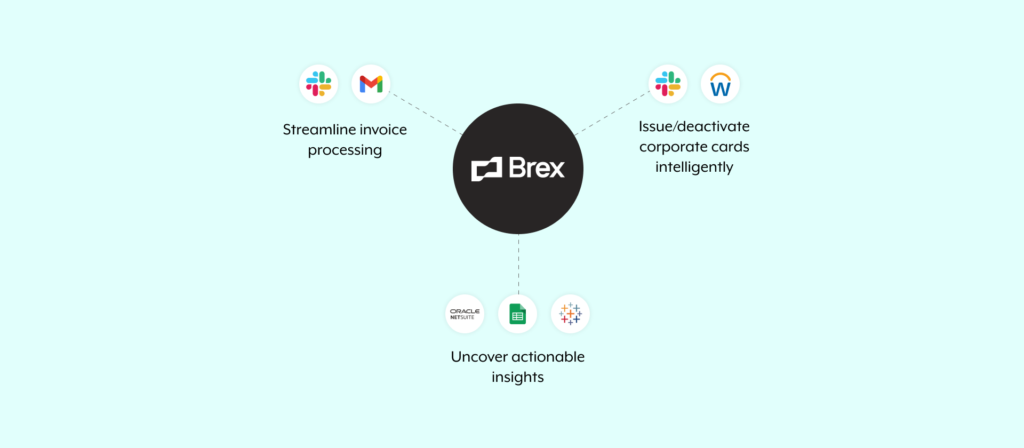

But automation’s value in the context of finance workflows extends beyond preventing mistakes and providing time savings. We’ll show you how they can truly transform the experiences you deliver to employees and vendors by breaking down 5 automations you can build with Brex, an innovative financial stack designed for fast-growing companies.

We’re excited to announce that our Brex connector has just gone live! Learn more about how you can use it by reading this press release.

Issue and deactivate corporate cards intelligently to enable employee spend and minimize risk

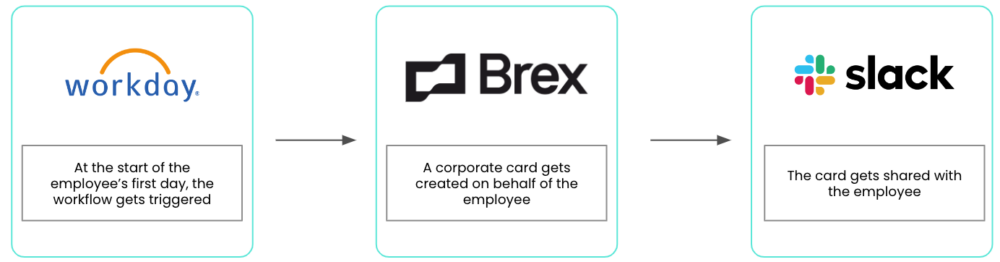

An employee might need to make certain purchases soon after joining your company, whether it’s for their home office or it’s for an upcoming trip to meet their new colleagues.

You can empower them to make these purchases, among others, independently and as soon as they join by integrating Brex with an HRIS like Workday. Once connected, you can set up a workflow automation that’s triggered at the start of the new hire’s first day (according to your HRIS). A virtual Brex card will then be issued to the employee in the platform they’re already working in, like Slack, allowing them to access the card easily and quickly.

Once someone is set to leave your company on the other hand, you’ll want to ensure that their corporate card gets deactivated from the moment they’re no longer an employee. Otherwise, you risk facing unwanted expenses.

To ensure that former employees can’t use their Brex card, you can leverage the integration between Brex and your HRIS. However, this time, the automation gets triggered at the end of the employee’s last day, as shown in their profile within your HRIS. From there, Brex immediately deactivates the card, and your employees in HR receive a confirmation via a specific channel in Slack.

Related: Everything you need to know about back office automation

Analyze financial data in more depth to uncover actionable insights

Relying on analytics from any one source is likely a faulty strategy. It can lead you to miss the bigger picture, neglect key trends, and ignore information that requires immediate attention.

You can avoid these issues and analyze your financial data more effectively by integrating Brex with other applications that store financial data, such as NetSuite, and with a data visualization tool like Tableau. From there, you can build real-time data syncs between your finance systems and your data visualization tool; and since the latter offers powerful features for understanding real-time data, your team will be all the more empowered to make informed decisions on time.

Alternatively, if you prefer to analyze data in a place like Google Sheets, you can simply build a workflow automation where data from Brex and other financial systems are exported on a specific cadence and added to a specific sheet.

Streamline your invoicing workflow to ensure payments get made on time

Maintaining positive working relationships with vendors is crucial to keeping your business running effectively over time.

One surefire way to preserve these relationships—and even delight vendors—is by paying invoices on time and in full, consistently.

Here’s how automation can help you do just that:

Once an invoice comes in via email or CSV, the workflow gets triggered. A payment card is automatically created in Brex and a Slack message is sent to a specific channel with the accounts payable team; the message shares information about the invoice and gives your finance team the option to approve or reject it in one click; once approved, the payment gets made with the Brex card in real-time.

These use cases are only scratching the surface. Discover additional automations you can build with Workato’s Brex connector by scheduling a demo with either the team at Brex or Workato.