Your finance team likely stays in the office well after hours.

The work that’s keeping them most busy, however, is probably manual and tedious—whether it’s transferring journal entries to a general ledger, reviewing invoices before sending them, or identifying payments they need to make across their network of vendors.

You can help your team avoid long work days by streamlining a number of their day-day tasks through finance automation. In the process, you’ll allow them to devote more of their time towards the work they truly enjoy and that delivers more value to your business.

We’ll walk you through everything you need to know about finance automation so that you can begin to use it effectively at your organization!

Table of contents:

1. What it is

2. Why it’s important

3. How to implement it

4. Its future impact

Related: The ultimate guide to ERP integration

What is Finance Automation?

Finance automation has been associated with robotic process automation (RPA), which is essentially a software bot that automatically performs specific tasks on your behalf.

The definition of finance automation has evolved alongside the rise of enterprise automation (EA). You can now think of it as the use of business events (or triggers) in your apps that drive real-time outcomes (or actions). Your outcomes can take a variety of forms, such as routing a purchase order to the appropriate approver, or automatically sending an invoice to a customer.

Through this new definition, finance automation can effectively scale with your business and be used by non-technical employees (more on this later).

To help illustrate how finance automation can work today, let’s look at how Quick Base, the world’s #1 no-code application development platform, automed its month-end close.

They connected the tools they were already using in the process: their procure-to-pay tool (Quick Base app) and their ERP (NetSuite) to create an AP subledger.

They then built a workflow in Workato, an enterprise automation platform, that enables them to automatically add any bill from the Quick Base app to Netsuite. The app also posts the bill to accounts payable, where it stays until the payment is made.

This workflow effectively prevents accounting from manually booking accounts payable every month, which saves their team two work days per month!

Learn how other organizations use finance automation to streamline critical processes by downloading our ebook, “The Role of Financial Automation in High Growth Companies.”

Why Finance Automation is Important

Here are just a few reasons why finance automation is critical.

It saves your team a significant amount of time.

Though the time savings from our Quick Base example is impressive, it doesn’t tell the full story.

Finance automation can also help you save time on a variety of other tasks, like generating invoices, communicating an invoice’s status, and gathering approvals.

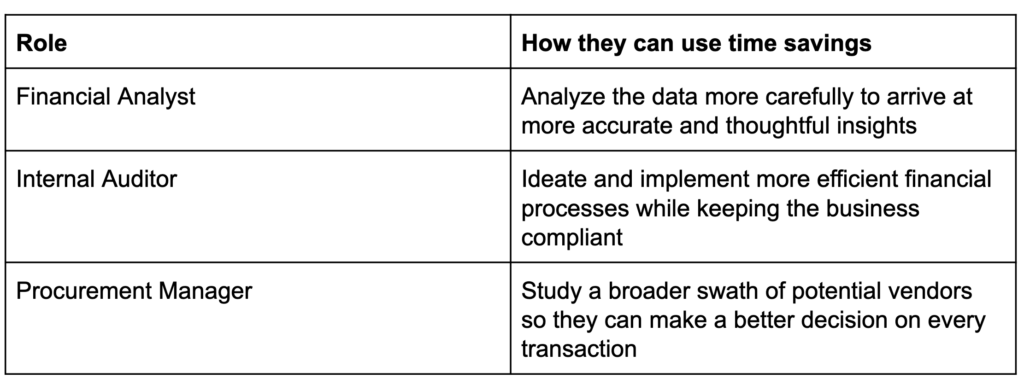

It allows your team to focus on more strategic initiatives.

Here’s how some functions within finance can use their newfound time:

It prevents your team from making costly errors.

Accidents, no matter how small, can get you in trouble—whether it’s with higher-ups, auditors, vendors, or customers. Finance automation can help mitigate any accident by streamlining manual, error-prone tasks.

It encourages collaboration between finance and IT.

Your colleagues in finance can tell IT which systems they need to integrate and how they want the data to flow between the systems. This may be enough for IT to move forward and begin building your integrations and automations. But given IT’s rich experience, they may identify additional automation opportunities, and offer better ways to automate a given process.

Related: The top 5 reasons why procure-to-pay automation is critical

How to Implement Finance Automation

Now that you understand what finance automation is and why it’s important, you’re ready to explore the steps for building any!

1. Identify the specific processes you want to automate.

Nearly any financial process can improve with automation. The big question is where you start. To help guide your decision, try to identify and prioritize the specific processes that require more manual effort from your team.

Many businesses begin with accounts payable and procurement, quote to cash, and financial reporting.

2. Review the state of each process—and potentially improve it.

Automations are only valuable when they’re built on top of optimal processes. Jason Pikoos, Lead Partner at Connor Group, explains further:

“If you automate a bad process, it’s still a bad process. It’s just got a pretty interface. A common thought is that process problems are technology problems, but usually it’s the process.”

So take a look at all aspects of a process, including the technology and colleagues that are involved. And make sure you also loop in the appropriate stakeholders during your review. That way you’ll not only identify more areas of improvement but also prevent future requests for changes.

Once you’ve aligned with your team on the best process, you’re ready to start building the workflow automation in the enterprise automation platform.

3. Identify and connect all of the relevant applications.

Each of your financial processes likely uses several applications both in and outside of the finance department.

For example, for quote to cash, your team might use a customer relationship management platform, an application for invoicing, a tool for collecting payments, and finance hubs like NetSuite and Workday that are at the center of it all.

Take the time to identify all of the applications you’ll need.

4. Work with IT to build out the workflow in the EA platform.

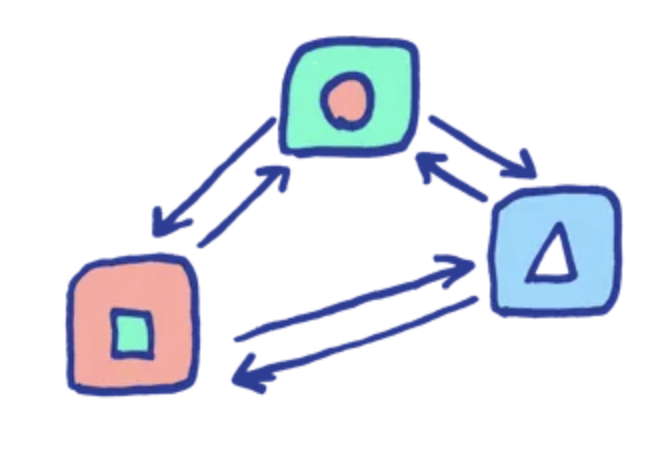

This involves building out business events that the EA platform “listens” for and the corresponding real-time outcomes they drive.

Related: The most meaningful finance automation stats in 2022 (based on our research)

How Finance Automation Will Affect the Workplace

Finance automation is fundamentally changing how your team works. Over time, these changes will impact your department on a more macro level. Here’s what you can expect:

- The demand for certain roles will shift

The automation of administrative, manual tasks may lead your organization to hire less payroll specialists and accounting clerks; while the ability to easily access data from several sources may increase the demand for people who can effectively analyze and interpret large data sets (i.e. financial analysts and data scientists).

- The finance department will collaborate with other teams more often

Now that your finance department can collect a wider range of information, from sales data to employee retention, your team can act as more strategic consultants for other internal functions.

For example, your team can help educate sales leaders on the specific types of customers that have a higher lifetime value. And you can partner with leaders in HR to restructure compensation plans in ways that better motivate employees and retain them for a longer period.

- Customer expectations will continue to grow

Customers have little patience for poor experiences. According to a study by PwC, about a third of customers would leave a brand they love after just one bad experience.

As your team continues to adopt advanced technologies and face increasing competition, customers’ expectations and demands should only rise. This makes it all the more imperative to adopt finance automation—along with marketing automation, IT automation, etc.

Related: How to automate invoice processing

Ready to Start Implementing Finance Automation?

Workato is a no-code enterprise automation platform that allows your finance team to build and automate workflows 10x faster than traditional iPaaS platforms. Your team can get started by reviewing any of the thousands of recipes* our users built!

*A recipe is the set of steps Workato follows to get work done between your apps.

You can also schedule a demo with one of our automation experts to learn more about the types of finance automation we can help you build.