In a recent survey conducted by Harvard Business Review Analytic Services, 44% of CEOs said that in their businesses, the finance team drives workforce planning. This statistic demonstrates what finance employees have long known: they play a key role in not just maintaining current operations by tracking budgets and expenses, but they’re crucial to planning for the future and making sure growth is sustainable.

One of the most crucial resources for finance teams are powerful hub apps like Workday. From tracking expenses to monitoring procurement budgets, these apps offer teams a central system-of-record. The wealth of data they contain guides high-level decisions about risk, strategy, and growth.

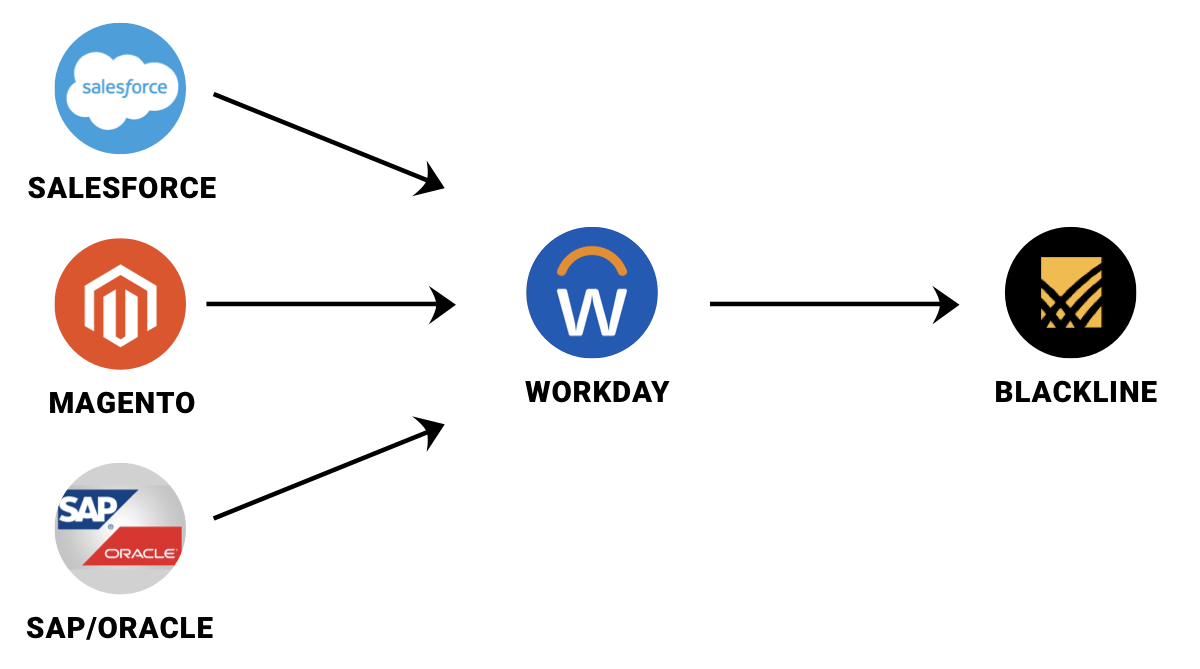

Today’s enterprise app ecosystem involves much more than just hub ERP programs like Workday, however. As SaaS has become mainstream, more and more enterprises have embarked on long-term digital transformation journeys—which means that finance and accounting teams have more tools available to them than ever before.

In order to make the most of features like reporting and analytics (and even your general ledger), your core finance app needs data from these ancillary apps and programs. But with so much financial information being generated—and changing!—on a daily basis, it can be difficult to make sure you always have the most accurate and up-to-date numbers.

Intelligent automation and integration can help you move data between Workday Financial and other apps, orchestrate complex workflows across all your systems, and get a better picture of your finances. Here are a few common ways that Workato customers use our platform with Workday Financial!

Related: How finance automation has evolved

Creating a Trustworthy General Ledger in Workday

One of the most difficult aspects of managing an organization’s finances is making sure that your system of financial truth (i.e. Workday) is as accurate as possible. General ledgers provide a bird’s eye view of your business’s finances, but to do so, they must synthesize complex information from many other sources, such as your CRM, payroll, eCommerce, and procurement apps. This can be hard to do intelligently because manual data entry is prone to mistakes and blunt, out-of-box integrations can create unwanted duplicates.

Workato offers a more intelligent, nuanced approach to syncing other apps with your general ledger. You can define complex business logic and build recipes based on that logic, so you can trust that your ledger won’t have errors or duplicates. Workato has pre-built connectors for hundreds of apps, so no matter what your app ecosystem looks like, you can create an up-to-date, error-free general ledger in Workday.

Workato can also then move this general ledger information into specialized accounting programs like Blackline, to help you automate specific processes like the end-of-month accounting close.

Related: How to automate accounts payable

Automatically Converting and Updating Workday Journal Entries from Salesforce

One of the most common Workday Financial integrations is with a CRM like Salesforce. And for good reason: there’s often a lot of information that must move between the two systems quickly and accurately. If you’re facing the tedious process of manually moving transaction data from your CRM into your finance app, integration can significantly lighten the load.

For example, you can use Workato to automatically convert Salesforce transactions into debit and credit entries. The automation then stores the journal entries as a set of clean data as a custom object in Salesforce, ready to be moved into Workday.

You can also create an automation to monitor the transactions recorded in the journal entries for changes and update these journal entries to reflect the actual amount paid. While data entry staff can still double-check the entries for accuracy occasionally, this drastically reduces their workload. And if something needs to be updated, a staff member can make the change in the CRM, and Workato will automatically update the corresponding journal entries. When the journal entries are flagged as ready to sync, it triggers Workato to send all the batches that are ready into Workday in real time.

Syncing Apttus Quotes with Workday Orders for Better Cash Flow Management

It’s crucial to make sure all your financial and sales data is available to the right people, so your accounting is accurate and you can have solid reporting and pipeline management. But moving all that information—and keeping it organized—can be tedious work, especially if you sell at a high volume!

If you use a CPQ app like Apttus together with your CRM, you can easily link quotes and line items to the correct orders in your Workday Financials business app. Workato can automatically link Apttus assets with the contract line in Workday, so all your order information is right where it needs to be.

Related: How payroll automation can improve the employee experience

Syncing Available-to-Promise Information Between Workday and eCommerce Apps

A crucial part of any successful eCommerce operation is making sure that items listed for sale are actually available. Inventory can change quickly, so it’s important to make sure your eCommerce platform—such as Magento—is up-to-date with the most recent product availability information from Workday.

Workato can sync both apps automatically, either in real-time or on a schedule, depending on your business needs. This integration not only eliminates the need for manual updates, but it also decreases the likelihood that customers will purchase items that are unavailable or on backorder. It also means that your eCommerce app can display expected delivery dates to customers, so they have the most accurate information before they make a purchase!

Onboarding, Provisioning, and Upgrading Customers, Partners, and Vendors In Real-Time

If you offer a digital or subscription-based product, it’s important to deliver features and services to your customers as soon as possible after they’ve paid for them. This often involves provisioning access or unlocking paid features depending on the customer’s subscription tier. This process can be tricky, however, because customer and product information is often managed in a different system than your invoices. There can be a significant delay between when a customer pays for a feature and when it’s actually available to them,

Workato can bridge the gap and enable you to onboard, provision, and upgrade customers in almost real-time. By connecting your customer system with Workday, Workato can unlock features as soon as invoices process. You can also use a similar workflow to onboard and provision partners or vendors once their contracts have been signed and submitted.

Connecting Your Procurement App to Workday

Many companies use specialized apps like Coupa for procurement and contract management. The procure-to-pay process is often time-sensitive, because it determines whether your organization has the resources it needs to function.

These apps still need to connect with Workday, however, so that you can have greater visibility into spend, make sure you are always on budget, and guarantee adherence to supplier contracts.

With Workato, you can create a variety of workflows that keep your procurement and contract management app (or apps!) synced with Workday. For example, if you use Coupa to store supplier delivery and payment info or contractual agreements that have price limits, Workato can automatically push the transaction details for the procurement into Workday Financial. This way, you can leverage the power of best-of-breed apps while still maintaining Workday as your financial system of record!

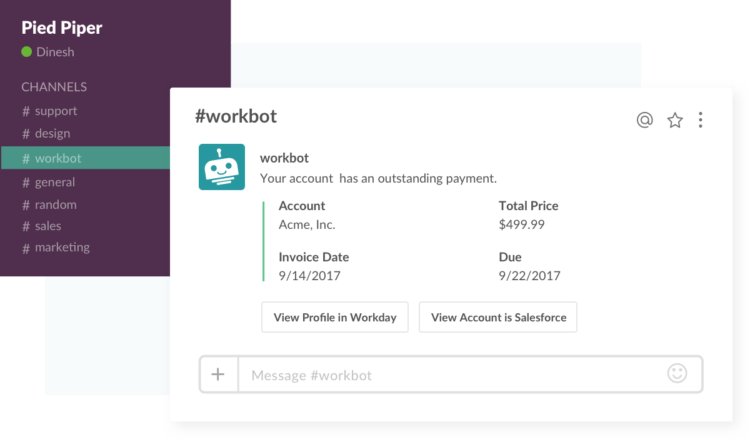

Future-Proof by Incorporating Slack Into Your Workday Financial Workflows

Workato supports almost every Workday automation and integration imaginable, so if you need to incorporate extra steps, we can help you do it.

One of the best ways to round out a workflow is by incorporating Slack, or another chat app. With Workbot for Slack, a bot we designed to allow you to do work in other cloud apps directly from Slack, you can work with records in Workday (or other apps like Salesforce) without ever leaving the chat console.

For example, you can get notifications in a specific Slack channel every time an order processes in Workday. Or, if you want a notification whenever a payment has not been completed in Workday, Workato can look up who the account rep is for that customer inside of Salesforce and send the notification to the specific account rep to let them know there is an outstanding payment.

You can even execute approvals directly from Slack, and Workato will update the information in Salesforce and Workday as appropriate. If you’ve already connected your key apps, adding Slack to the workflow is an easy way to boost your productivity!