We’re in an era of compounding technological advancements in finance. As the financial tech stack continues to grow, finance departments are increasingly turning to automation to streamline operations, reduce errors, and enhance decision-making. Finance teams can now leverage powerful integrations and automations to transform their workflows. Here are five key concepts of cutting edge finance automation, plus best practices to harness the advantages they offer.

Integrate Core Financial Systems

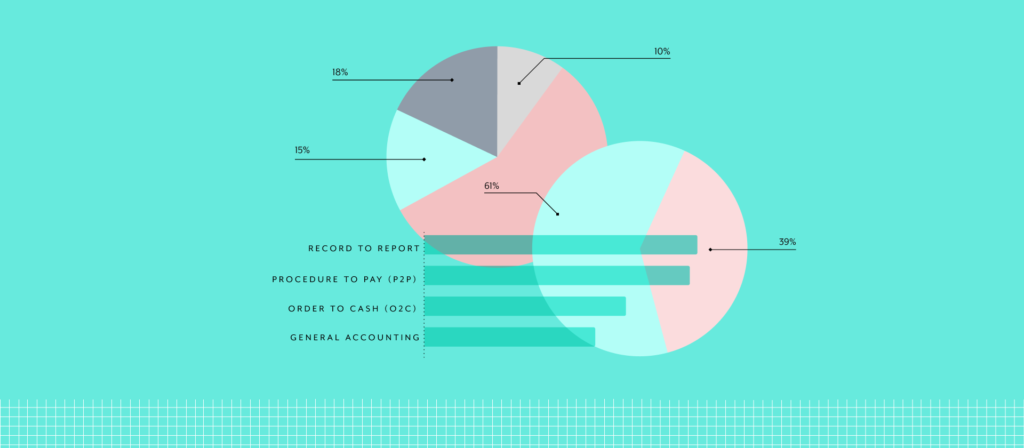

Netsuite and Oracle ERP are leading the way in finance automation. These systems are crucial for automating core financial processes such as record-to-report. By integrating these ERP systems with other financial applications like SAP and Coupa, businesses can create a seamless financial ecosystem that enhances data accuracy and speeds up financial reporting.

The big players in fintech continue to iterate and grow. Your fintech stack likely incorporates one or more of these, so it’s important that they work together seamlessly.

Best Practice: Ensure Seamless Integration

Use platforms like Workato to integrate ERP systems with other financial tools to ensure data consistency and real-time visibility.

Automate Order-to-Cash

The order-to-cash process is a critical area where automation can drive significant efficiency gains. According to industry data, order-to-cash accounts for over 70% of all financial process automations. Automating this workflow can help businesses handle increased digital buying behavior more efficiently. When demand scales, automated order-to-cash can scale with it, which means better customer service and a better bottom line.

Best Practice: Streamline Customer Transactions

Automate the entire order-to-cash cycle, from order placement to cash receipt, to reduce cycle time and improve customer satisfaction.

Financial Data Management and Reconciliation

Financial data is often scattered across multiple business applications, especially for large organizations. But managing disparate data sources is key to reducing risk. By automating financial data reconciliation processes, you can help align data from various sources and improve the reliability of financial insights across the org.

Best Practice: Automate your Data Reconciliation Process

Use tools like Workato to automate the extraction and reconciliation of financial data wherever it may be across the org. Timely. Efficient. Easy.

Optimized Procure-to-Pay Workflows

It’s hard to overstate the benefits you can gain from automating procure-to-pay. This is one area where rapid scaling without the right procedures in place can create a big mess. With automation, companies can handle thousands of invoices and approvals efficiently, reduce the procure-to-pay cycle time and enhance cash flow. Plus, it creates predictability, which is the hallmark of a solid financial automation strategy.

Best Practice: Automate Vendor Onboarding and Invoicing

Streamline the entire procure-to-pay process, from vendor onboarding to invoice processing and payment, to achieve faster cycle times and better compliance.

Leveraging AI for Financial Decision-Making

The integration of AI in financial processes is a game-changer. AI can help in automating complex decision-making processes by providing timely insights and forecasts. If your fintech stack changes or financial circumstances fluctuate, instead of going to a committee, you’re able to get up-to-the-minute analysis and AI assisted forecasting. This not only speeds up the decision-making process but also enhances the accuracy of actionable data.

Best Practice: Implement AI Analytics

Don’t bash your head into the wall fitting disparate data sets together. Put your data to work for you. Modernize your data analytics with automation and AI.

Finance Automation with Workato

Workato orchestrates end-to-end processes including invoice reconciliation, purchase order closure, and international payments. We do it without complex code and in a scalable, user friendly interface. Workato’s finance automation capabilities bring every best practice under a single pane of glass. We use AI to constantly improve process flows and our LLM prompt allows you to build automations using natural language. Rest assured that wherever the future of finance goes, we’ll be right there driving better outcomes for your business.

Want to see more? Try Workato for Free Today.

Learn how Workato can help you implement cutting edge financial automation and integration without having to write a single line of code.