A leading firm in the enterprise software industry, Atlassian builds team collaboration tools like Jira, Confluence, Bitbucket, and Trello to help teams across the world become more nimble, creative, and aligned.

Over the past 5.5 years, while the company supported multiple global businesses in their growth, Atlassian, too, was scaling rapidly. To ensure their business processes kept pace with the company’s growth, Atlassian established a centralized Intelligent Automation (IA) function to lead digital transformation efforts within the company.

The Centre of Excellence team, one of three IA sub-teams in Atlassian, plays a critical role in this initiative. Helmed by Srividya Sathyamurthy, Senior Manager of Intelligent Automation, they work closely with internal teams across the company to implement automations and integrations.

One of the major areas that Atlassian needed to streamline were their finance processes, which included accruals, account payment inquiries, and account validations. These processes were highly manual and required over 25,000 man-hours to execute per year.

The Centre of Excellence team needed a tool that could help the finance team scale their processes quickly and empower them to take ownership of their automations.

Before we dive into the details of how automation solved their problems, let’s first address the challenges that the team had to overcome.

Related: The role of intelligent automation at Atlassian

The challenges of RPA-only automation

To help increase the finance team’s efficiency, the Centre of Excellence team started off by leveraging RPA (robotic process automation) software to automate repetitive tasks, like extracting and processing data from their ERP platform’s saved search reports. However, this automation was heavily dependent on the ERP platform’s user interface (UI), which meant that the automation would break down each time there were changes to its UI. The team would then have to spend additional time re-writing the workflow in their RPA tool.

Compounding the problem, the Centre of Excellence team had 40-50 bots that they had to maintain manually. As the bots were built with RPA tools, they needed to allocate more time towards developing them and conducting User Acceptance Testing (UAT). When something in the system broke down, a lot of time was required to fix the issue. The team was also heavily involved in building simple, low-impact automations for business teams, which prevented them from focusing on larger projects that truly mattered to the business.

Over time, the Centre of Excellence team’s technical debt grew. They realised that RPA alone was not enough to meet the needs of the business.

Searching for a low/no-code automation tool

The Technology Innovation Team, another one of three IA sub-teams in Atlassian, searched for a low/no-code automation tool that would meet the following criteria:

- Easy to learn, understand, and use

- Extensive documentation and community support

- Easy to maintain, deploy, and scale

They experimented with Workato and several other platforms, but chose Workato because the platform stood out in the following areas:

- Has extensive build-in/community connectors (for e.g. Coupa, Jira, Google Sheet)

- Is able to create custom connectors for Atlassian’s complex use cases

- Is flexible in building a variety of automations through webhooks, scheduled triggers, API requests, event triggers, and more

- Being a SaaS product, it can run on any machine’s web browser

Thereafter, the Centre for Enablement Team, another one of three IA sub-teams in Atlassian, helped to establish strong governance guardrails in order to enable the enterprise to easily leverage the Workato platform.

Now that the foundations were established, the Centre of Excellence team could leverage Workato to help Atlassian’s business teams quickly learn and write simple automations on their own. Srividya elaborates:

Building end-to-end finance automations

The Centre of Excellence team first used Workato’s Workbot to automate sending notifications to relevant stakeholders via Slack whenever there were status changes in Coupa and Expensify (expense management tools used by Atlassian).

The workflow soon expanded to include integrations with an ERP platform that Atlassian uses, allowing their team to automate accruals, accounts payable inquiries, and account validation.

1. Accruals automation

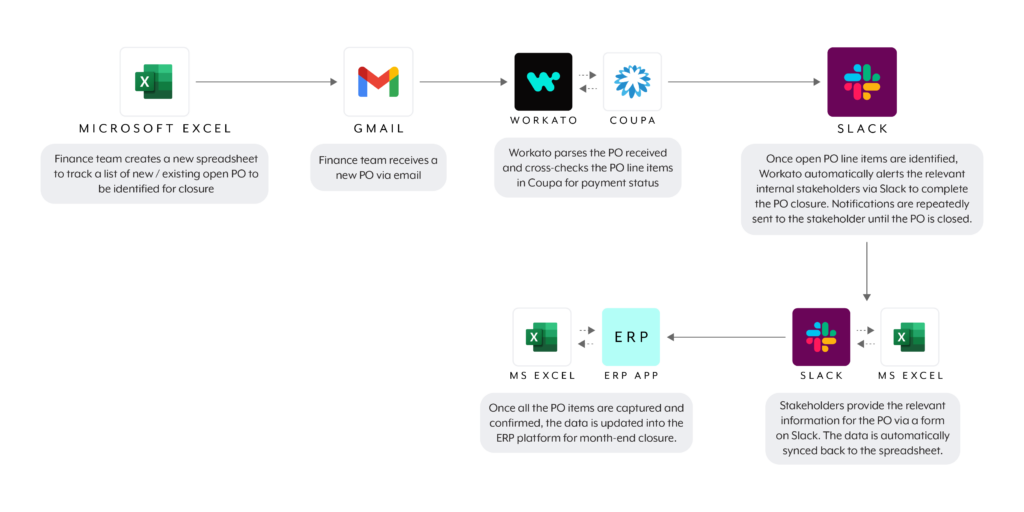

Atlassian’s Centre of Excellence team built this automation to help the finance team easily manage the closure of purchase orders (PO) in the ERP platform. Here’s how it works:

- The finance team creates a new spreadsheet to track the list of new or existing POs for the month-end close.

- When the finance team receives an email with a new/updated PO, Workato parses the PO data and looks for any open PO line items in Coupa.

- Once the open PO line items are identified, Workato prompts the relevant internal stakeholders via Slack to provide more information in order to complete the PO closure.

- The information submitted via Slack is synced back to the spreadsheet and then to the ERP platform for the month-end closure.

2. Accounts payable automation

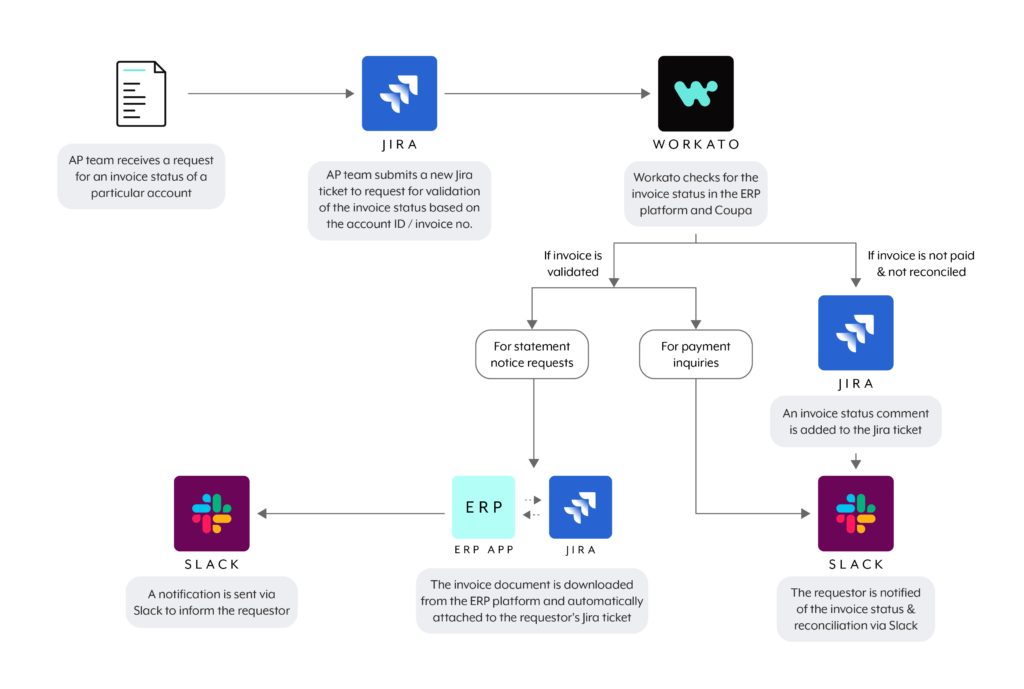

This automation helps the accounts payable (AP) team automatically validate and reconcile invoice statuses. Here’s how it works:

- Upon receiving a request for an invoice status, the AP team creates a new Jira ticket that requests invoice validation based on the vendor name and invoice number.

- Once the Jira ticket is submitted, Workato runs validation checks in the ERP platform and Coupa to check for the invoice status.

- If the invoice is validated, the invoice statuses across Coupa and the ERP platform are consolidated, and the information is sent to the relevant stakeholders via Slack.

- If the stakeholder has requested a statement notice, the invoice document is downloaded from the ERP platform and shared through a Jira ticket attachment. The requestor is then notified of the invoice status.

3. Account validation automation

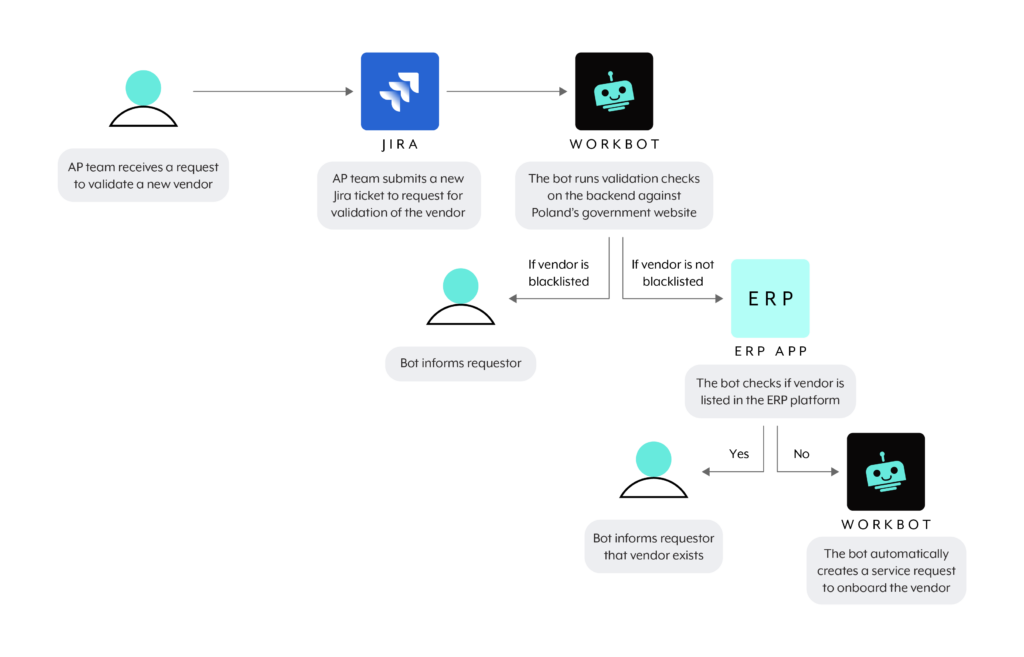

This automation helps the accounts payable team validate vendors based in Poland before they make payments to them. Here’s how it works:

- Upon receiving a vendor validation request, the AP team creates a new Jira ticket to request vendor validation based on the vendor’s account number.

- Once the Jira ticket is submitted, Workato runs validation checks against Poland’s government website.

- If the vendor is blacklisted, the information is notified to the relevant stakeholders by updating the Jira ticket and assigning it to the stakeholder.

- If the vendor is not blacklisted, the bot runs validation checks in the ERP Platform to identify if the vendor is already listed in the database. If the vendor does not already exist, the bot automatically creates a service request ticket to onboard the vendor.

Related: How Box’s IT and business teams work together to automate at scale

Significant time savings and dozens of automation builders within finance

Now, with their automated finance workflows, Atlassian’s Finance team is able to:

- Complete 8,000-9,000 end-to-end transactions per month

- Build automated workflows in less than 3 weeks, as compared to 2-3 months in the past

- Equip 49 employees in the finance team with the skills to automate

- Save approximately 25,000 hours on manual work annually

- Close accounting books in 3 days every month, as compared to 8 days before Workato

- Validate invoice status requests in 2 minutes as compared to 15 minutes in the past

- Validate vendor accounts requests in 2 minutes as compared to 10 minutes in the past

The future of automation at Atlassian

Atlassian hopes to increase their intelligent automation digital footprint across the business and be the yardstick for the future of work. With a good ecosystem established between Atlassian’s existing tools and Workato’s platform, Atlassian aims to lower the barrier to entry for building automations, and provide business teams with the support they need to achieve their automation goals. Srividya concluded: