By Bharath Yadla, VP of Workato.

The logistics industry, specifically freight movement, is going through significant changes and disruption. With big-name Silicon Valley startups like Uber and Lyft both IPOing recently, the travel and transportation industry is receiving a lot of renewed attention. The U.S. trucking market generates $260 billion in revenue—20% of a $1.2 trillion global market.

Two decades ago, Amazon fundamentally changed the way brokerage and marketplaces operate by leveraging technology platforms. Now, the Amazon effect seems to have hit the logistics and trucking industries.

Traditionally, third-party logistics providers (3PLs) were more asset-driven with their fleets and storage operating across the supply chain. But with the entry of companies like Amazon and Uber into the consumer transportation industry, technology is starting to change the terrain for the commercial logistics industry as well.

The usual process is for a shipper to place an order tender via EDI hub to the freight broker, schedule the order for freight pickup, and then load it onto the truck (which can get complicated if the truck isn’t full). From there, transit management would traditionally come into play until the order is delivered and unloaded.

That last step—delivery—has become more and more complicated with the advent of eCommerce. With more retailers promising ambitious delivery timelines (sometimes within 24 hours of order processing), the “last mile problem” has become a significant concern—especially as large retailers like Amazon and Walmart fight for dominance.

Related: What is EDI?

A new generation of logistics providers

Fast forward to today . The evolution of logistics players from asset-based to asset-less has been turbocharged by technology revolutions. Cloud-based tech, the platform economy, blockchain, AI/ML, real-time data analytics, API-fication, ELD, and IoT have fostered innovative ways of operating logistics businesses—and logistics companies’ business models.

For example, key players like Flexport have disrupted the logistics industry by adopting a digital-first approach to digital freight forwarding. With a platform-based approach, they offer retail customers the ability to plan, move and even finance their cargo more efficiently. Their OceanMatch is a great example of the “Uberization” of overseas container movement.

Similarly, companies like Convoy act as matchmakers between trucks and shippers. Founded by a team of former Amazon employees, Convoy is attempting to be the eBay of the truck space catalogue.

So what makes these logistics companies so successful?

While these businesses and their positioning vary , there are three common characteristics that define logistics leaders:

- Business agility driven by a platform business model

- A data-driven approach that enables decision automation in real time

- Automation of business processes across the chain, both within the organization and across interactions with external entities like clients.

While the first characteristic largely relates to business transformation, 2 and 3 predominantly revolve around data and technology. Successful digital-first logistics providers have considered:

- How well their business systems are integrated

- Whether those systems can adequately support business agility

- How quickly they can make data-based business decisions.

This starkly contrasts with how logistics businesses have traditionally operated. Once an order is received, the logistics provider has to execute a series of highly complex steps including order evaluation, dispatch, schedule confirmation, notifications, and loading coordination. Traditionally, logistics companies relied on humans to execute these steps, which naturally increases the shipment cycle time.

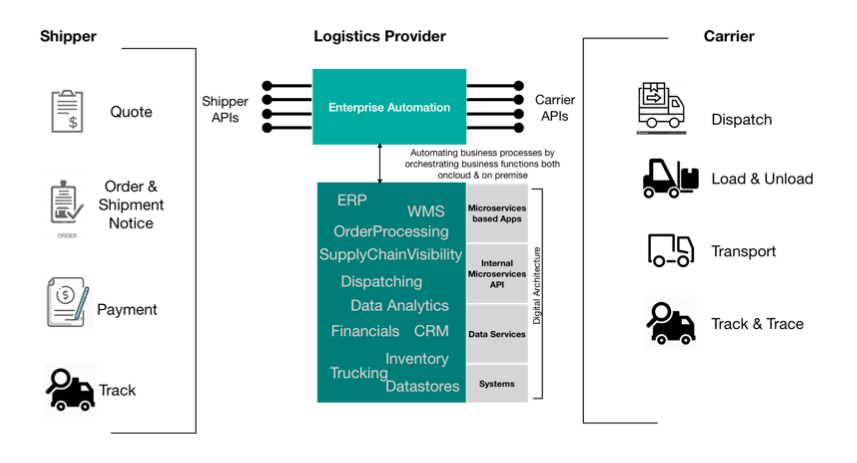

This is where the need for automation technology becomes glaringly apparent. In order to execute the end-to-end logistics chain efficiently, logistics providers need automation tools that:

- Can orchestrate the automation of business functions across multiple systems/data sources—whether they’re SaaS and legacy.

- Can scale along with business growth yet maintain a lower total cost of operations (TCO)

- Can easily and seamlessly integrate with partner, customer, and internal app ecosystems.

Enterprise automation : the strongest link in the logistics chain

For digitally native logistics companies with a blossoming app ecosystem, the need to have data move between those apps leads to automation of business processes from the get-go. If they want to remain competitive with this new generation of logistics companies, traditional providers must also automate more.

A key element of this will involve moving towards an API-driven platform strategy for attaining business agility. Given that traditional logistics providers largely depend on EDI-based exchanges of information, they are naturally curtailed from operating at the same scale as highly digital companies.

As these traditional logistics providers digitize their solutions/offerings and transform into true digital companies, they can’t completely ignore EDI. But moving towards an API-driven platform strategy will help drive the need for end-to-end automation of business processes across the enterprise and enable the real-time flow of business-critical information between apps.

A great example of a traditional company that has successfully made the transition to digital is C.H. Robinson. A 100+-year-old company, they’ve evolved and transformed multiple times in the past—and now they’re embracing the technologies discussed above to drive their transformation and compete with the digitally native logistics players. With their Navisphere, FreightView, and developer API, they’re setting themselves up to be equally competitive.

Ultimately, both new logistics players and traditional shipping companies need automation technology to be a strong link in the end-to-end shipping cycle. It’s critical that these providers consider the core abilities mentioned above when choosing an automation tool.

It’s also crucial that they use API-fication as a springboard to business-wide automation and drive transformation. As in any transformation exercise, traditional players can’t just scrap their old tech all at once; there will be some overlap. But in the end, the future of the logistics industry will be driven by new technologies like enterprise automation.