More than half of finance executives believe that improving their quote-to-cash process could lift their revenues by at least 5%.

The finding is easy to accept, as a high-performing quote-to-cash workflow allows your organization to move quickly across key stages of the sales process. All the while, it can help everyone involved—from sales reps to accountants—save time and focus on business-critical tasks.

So, how can you improve your quote-to-cash workflow? We’ll cover 3 automations that can make a big difference, but before we do, let’s make sure that we’re aligned on the definition of quote to cash.

Related: How to implement any type of finance automation

What is the quote-to-cash process?

The quote to cash, or Q2C, process is the actions an organization takes from the moment they configure and deliver a proposal to their analysis (and then improvement) of each step in the workflow. Completing the Q2C process involves close collaboration between teams in sales, operations, accounting, among, potentially, others.

The way that organizations perform quote to cash can vary to some degree. But generally speaking, your organization likely follows some version of the following:

1. Configuration: Using a CPQ tool, your team crafts a proposal and then sends it out.

2. Negotiation: Your team and the prospect compromise on the terms of engagement.

3. Quote: You send the prospect a quote that reflects the terms discussed and agreed upon.

4. Executed contract: The contract gets signed by the relevant stakeholders.

5. Invoicing: An invoice gets created by your billing system and gets sent over to the new client.

6. Payment received: Your organization receives the payment, but depending on the nature of your business, your team may not be able to recognize the payment as revenue just yet.

7. Analysis: Using the tools available, your team analyzes the performance of each step and reports on the insights uncovered.

8. Process improvement: Based on the findings, your team takes steps to improve the quote-to-cash process.

Related: What is lead to revenue? And how is it different from Q2C? Here’s what you need to know

How to automate quote to cash

With this definition and these set of steps in mind, let’s dive into 3 ways you can automate your quote-to-cash process.

1. Manage approvals intelligently and quickly

Internal approvals are a necessary part of moving a deal through the door—whether it’s getting sales leadership to sign off on a quote or having a colleague in legal approve any redlines.

To help your reps receive approvals quickly, and in a way that’s convenient for the approvers, you can turn to automation.

For example, here’s an automation that requests someone in legal to review and approve of the client’s redlines:

1. Once a sales rep submits a new deal desk request in a CRM like Salesforce—which requires selecting the nature of the request and providing the prospect it’s for—the workflow gets triggered.

2. The request arrives in a specific Slack channel, where the approver is tagged and can find specific details around the opportunity (opportunity name, amount, probability of closing, close date, etc.).

3. The approver can approve or reject the request with the click of a button in Slack, or, if they’d like to investigate further, they can click on the opportunity to visit the page in Salesforce.

Related: 4 automations that can shorten your lead lifecycle

2. Deliver your contract without any issues

After you’ve gone through the necessary approvals both internally and externally, you can ensure that the deal closes soon after by immediately sending the customer the contract.

Automation helps you do just that. For instance, you can connect platforms like Slack and Docusign and create a workflow where, with just a few clicks in Slack, the rep can send the Docusign agreement to the prospect.

Alternatively, you can integrate Salesforce with Docusign and create a workflow where once a rep checks off a specific field in Salesforce (signifying that the agreement is ready to be sent), it triggers the delivery of the Docusign agreement.

3. Create invoices seamlessly

Once an opportunity is closed, it’s up to your team to move quickly in creating and delivering the invoice.

Using automation, your finance team can all but ensure that the invoicing process moves fast and without any hiccups. To give you an idea of how it can work, here’s an automation that quickly creates an invoice once you’ve integrated a billing platform like Bill.com with a CRM like Salesforce:

1. Once a deal is marked as “Closed Won” in Salesforce, the workflow gets triggered.

2. The customer gets added to Bill.com (assuming they don’t already exist there).

3. The new client’s customer ID in Bill.com gets added back to their Salesforce account.

4. Using certain account details in Salesforce, the invoice in Bill.com gets created.

5. The new Bill.com invoice ID is added to the client’s Salesforce opportunity.

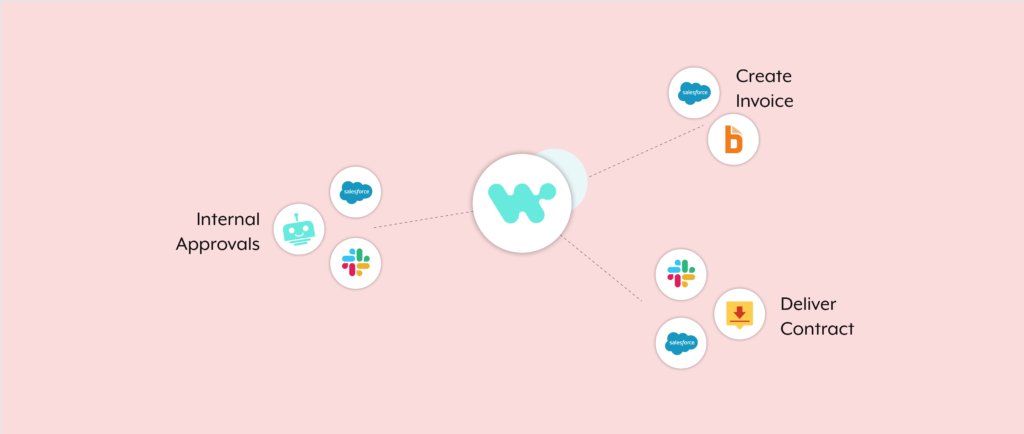

Automate your quote to cash with Workato

Workato, the leader in integration-led automation, can help your organization integrate all of the relevant apps and build any and all of the workflows outlined above. The platform also offers Workbot, an enterprise chatbot that can help your employees perform many of the tasks throughout the Q2C process within your business communications tool (e.g. approving a quote).

To learn more about Workato and Workbot, you can schedule a demo with one of our automation experts!