Altus Financial is a chartered accountant and wealth advisory firm with offices in Sydney and Central Coast, Australia. With over 30 years of personal finance and SME advisory experience, the brand has emerged as a leader in the industry, recognized three years in a row at the Australian Accounting Awards between 2016 and 2018, winning four times. Traditionally, the firm used an on-prem accounting software that was hard to connect to other apps, including NetSuite, its practice management tool, and others for tax purposes, accounts, loan preparation, superannuation funds (or super funds), and corporate compliance. In connecting the on-prem software, MYOB, to NetSuite, they were granted a limited view as they could only transfer data one way towards NetSuite and had to manually enter any changes the other way around, compromising data integrity.

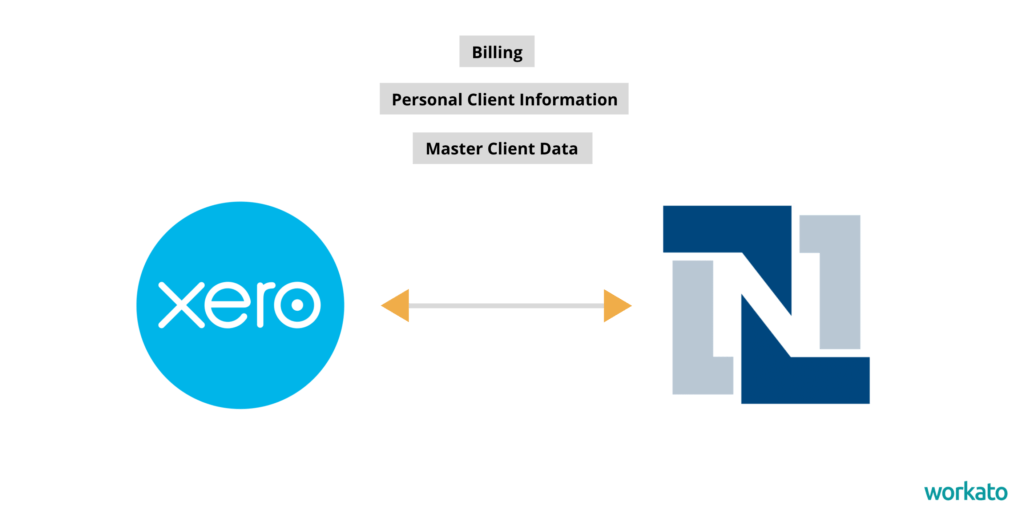

At the beginning of the 2019-2020 fiscal year, Altus opted to switch to Xero, a SaaS accounting software that could bi-directionally sync with NetSuite. The team was hoping to eliminate having two sets of client data and having to transfer it manually every single time. In looking for an integration platform for a number of other use cases, Altus opted to use Workato to automate data transfer between Xero to NetSuite.

Valerie Alexandrova, operations manager at Altus, says it saves administrative staff “heaps of time.” “Before, we’d enter the client data in NetSuite and then do the same in MYOB. But then what if address changes? Then they need to do it in both. What if some tax details changes? Then they need to do it in both. And that was highly exposed to human error because if you update it in one system, then you’d have to update it in other,” Valerie said.

“So over the years, those two sets of client data were absolutely different – there was no data integrity. Now with Workato, the client data in NetSuite is exactly the same in Xero because you only have to enter it once. So that’s a massive improvement for us and it does save a lot of time,” she added.

APPS

- Xero (which replaced MYOB)

- NetSuite

CHALLENGES

MYOB, the company’s old accounting software, was an on-prem system that didn’t talk to NetSuite, its practice management tool. To improve efficiency, the company later adopted Xero, a SaaS app, and wanted to automate client data transfer between Xero and NetSuite, as the former contained personal client information that’s required on tax returns and needs to be current at all times in its master data tool.

ROI WITH WORKATO

In less than 6 weeks, Altus built and launched an automated workflow between Xero and NetSuite, drastically cutting time from the data entry process and improving data integrity. The company is now looking to build integrations between a potential new CRM and NetSuite, as well as other apps.

Building Agile Integrations Quickly Between Xero and NetSuite to Ensure Data Integrity

Altus uses Xero to store personal client information such as date of birth, address, and tax file number (TFN) or Australian business number (ABN) – which must be listed on every tax return and synced with its master data tool, NetSuite.

In learning of Workato from another department hoping to integrate NetSuite with their CRM tool, Valerie was hoping to build the Xero-NetSuite integration herself and she did. “I just build it internally,” she said. “I’m really new to Workato, but I still found that it was user friendly and I didn’t require anyone from the outside apart from the actual support team to help me build that connector.”

“It was pleasant joining those two systems together,” she added.

Valerie said it took less than six weeks to get the process up and running, from training on using the platform to setting it live, which couldn’t come at a better time.

“In migrating the client data from MYOB to Xero, we realized how messy the client data was because it’s been sitting there separately for so many years,” Valerie said. “Simple things like client names would be different, addresses and all of that. It was very, very messy.”

“So we decided we can’t continue this way. It has to be one way. It has to be one master data and that’s when we introduced Workato.”

“It definitely cut time from double-entering data in both systems. It reduced time-to-enter new client data, reduced time to maintaining existing client data. You have this comfort now in knowing that it’s the same data, so that’s a huge improvement.”

Connecting to Their CRM (and Other Apps)

Altus is constantly working on improving and upgrading their tech stack, including a possible new CRM, with Workato serving as an essential part of their ecosystem to both migrate data from NetSuite into the new CRM and keep all systems in sync.

After researching integration platforms for more than a year, Valerie and her team are pleased with the progress thus far. “I’ve seen the biggest improvement in our systems and data integrity by using Workato and I’m sure we will be using it in other ways and connecting more systems in the future.”