Mike Flynn, the Head of Enterprise Automation at Rapid7, had a “zombie” problem.

The employees at Rapid7—a company that offers cybersecurity and compliance solutions and services—were plagued with performing tedious, manual tasks that prevented them from doing the high-value, mission-driven work of providing exceptional customer experiences.

Some of these “zombie” tasks for Rapid7 employees consisted of:

- Facilitating the 30+ integrations between Salesforce and NetSuite

- Fixing the 10% of orders that failed

- Determining which lines of business and individuals should and shouldn’t be involved in resolving order errors

These manual tasks were initially alleviated when Rapid7 adopted Workato in 2017 with a focus on integrating the powerful technology tools at their disposal. But, as Rapid7 leaned into Workato’s automation solutions, they uncovered efficiencies that are now a cornerstone of their FinOps.

You can learn more about how Rapid7 overcame the “zombies” with Workato by watching their session at Automate: “Bringing an automation mindset to finance”.

How Rapid7’s automated payment portal benefits the company and their customers

For Rapid7, automation isn’t just a tool, it’s an approach that should drive how work is done.

Flynn views his company’s digital transformation as beginning as a crawl (100% manual), graduating to a walk (manual tasks assisted by automation), and developing into a run (full automation that drives strategy and growth).

So, what does the automation solution look like when up and running? One example is Rapid7’s launch of their payment portal.

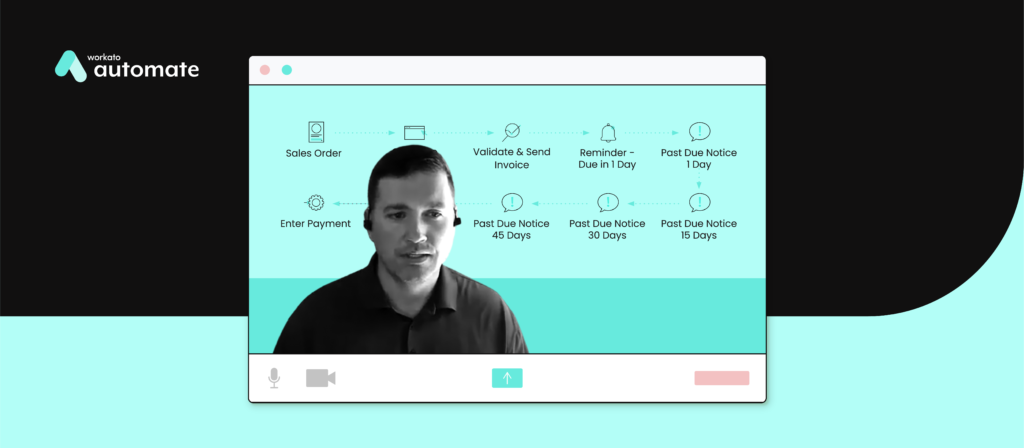

Invoicing had been a painfully manual process, requiring human action or intervention across at least 10 touchpoints, from when an order was made to payment from the customer.

The automated payment portal not only allows the team at Rapid7 to avoid performing manual tasks, but it’s also elevated the way that data gets processed and used to facilitate an even better customer experience.

The following image—shared by Flynn during his presentation—does a good job of encapsulating how the automation works and benefits both Rapid7 and their clients:

Related: A guide to automating quote-to-cash

Minimal work required by IT

Perhaps one of the most telling results of the automation mindset in use at Rapid7 is this statistic, shared by Flynn:

“IT averages just 1 hour of support per quarter!”

Despite the numerous integrations and complex orders being processed on a daily basis, IT sees errors so infrequently that they often require training to address them. This is largely the result of the daily automation reconciliation between the ERP and payment portal, which finds and resolves almost all errors.

In Flynn’s estimation, the partnership with Workato continues to be a “huge success.” Rapid7 employees have been saved from devoting considerable time and energy to managing technologies, and they can allocate more of their time, instead, to delivering better customer experiences.

To learn more about how Rapid7’s automation mindset motivates them to optimize their finance operations, you can watch their session from Automate, the #1 conference on automation.