As someone who works at a small business, you’re likely managing an endless number of tasks while working well beyond the traditional 8-hour workday.

To help manage your workload and to enable you to work from anywhere, you can turn to a variety of finance apps.

Today’s finance apps allow you and your team to perform just about any task—whether it’s sending an invoice, analyzing your finances, or submitting an expense. To help you identify and use the best apps, we’ve highlighted a few that are worth reviewing. These include:

Let’s review each!

Related: An introduction to finance automation

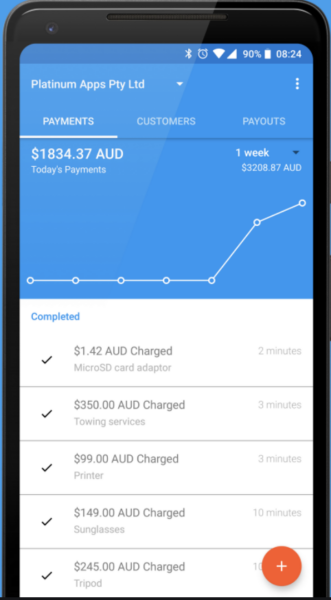

1. Stripe

The online payment processing platform’s app allows you to perform a variety of analysis and tasks wherever you are. You can use the Stripe app to:

- Track all of your payments and earnings across different time frames—whether it’s over the last week or during the past year

- Stay up-to-date on the latest activity by setting up push notifications for key events (e.g. a new payment comes in)

- Take action directly in the app, from emailing customers to giving refunds

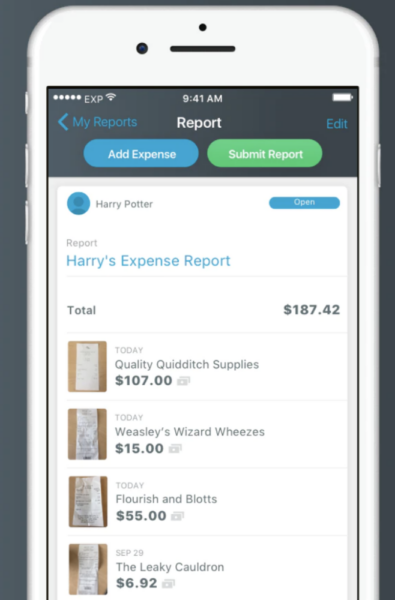

2. Expensify

The receipt and expense management software offers an app that can be useful for any employee. Leverage the Expensify app to:

- Scan and upload receipts (once a photo is taken, the app’s SmartScan technology allows it to read and import a receipt’s information instantly)

- Group receipts together and submit them as a report

- Approve or reject any expense request with the click of a button

Related: How to automate cash reconciliation

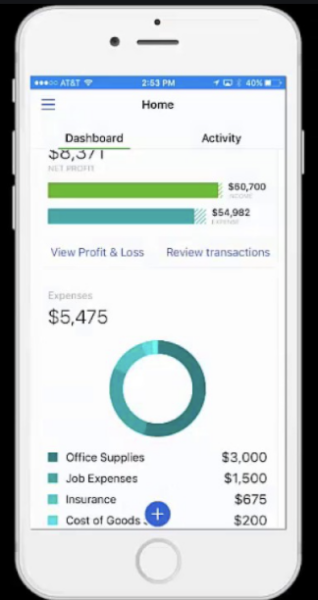

3. QuickBooks

The accounting software offers a versatile and valuable application for just about any small business. With the QuickBooks app, you can:

- Create, send, and track invoices

- Take a picture of a receipt and submit it as an expense

- Track business performance over time

- Sync with your bank account to transfer payments seamlessly

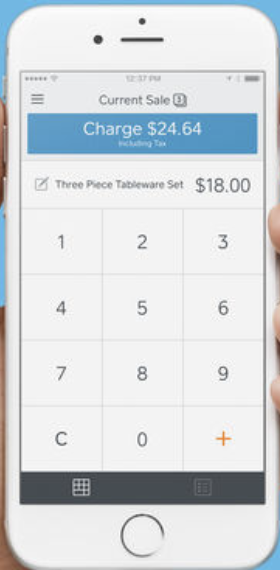

4. Square Point of Sale (POS)

The financial services company’s POS app can help small businesses sell their products, process transactions, interact with customers, and more. Here’s additional insight on how you can use it:

- Create invoices, send them on a recurring cadence, and track their progress

- Allow customers to pay either touch-free or via chip by using the app and a Square Reader

- Manage your customer list and reach any client directly through email

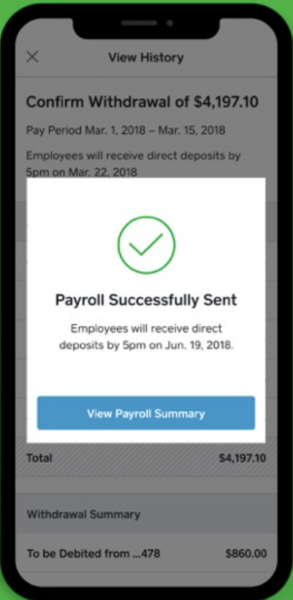

5. Square Payroll

Square’s payroll app (Square Payroll) aims to remove the time-consuming, tedious components that come with managing payroll. Use the app to:

- Pay employees and contractors with just a few clicks

- Add an employee’s hours worked and additional pay from Square’s Point of Sale app

- Submit your pay run and view your payroll summary any time afterwards

- Manage your payroll tax filings

Build End-to-End Automations Around Your Finance Apps

No matter how valuable a finance app is on its own, its utility only grows once it’s connected to other apps and used as part of end-to-end workflow automations.

Learn how Workato, the leading enterprise automation platform, can help you automate your finance workflows, from quote-to-cash to procurement, by seeing a demo from one of our experts.