Banks and credit unions stand at a crossroads. Their legacy core systems, often running on-premises, create silos and bottlenecks that slow innovation and impede responses to market demands. IT teams are forced to spend their day firefighting rather than building the future. But what if there was a better way?

Enter Workato; a modern integration and orchestration platform reshaping how financial institutions approach digital transformation.

Breaking Free From Legacy Systems

For years, banks and credit unions have wrestled with legacy systems that are notoriously difficult to integrate with modern cloud applications. Custom-coded integrations often fail to scale, forcing IT departments to manually handle critical operations and delaying essential processes like loan origination, customer onboarding, compliance checks, fraud detection, and customer 360-degree views.

The rigidity of these outdated systems also prevents financial institutions from quickly adapting to changing market conditions or customer expectations. As a result, banks and credit unions are consistently outpaced by agile fintech competitors and digitally native banks. As one CIO of a regional bank put it, “Moving cores is a significant undertaking for a bank…Workato is essential for switching from one system to the next.” This sentiment reflects a common challenge across the sector—needing the agility to shift rapidly without compromising operational integrity.

Modernization and Real-Time Agility

Workato tackles these challenges head-on with its low-code/no-code (LC/NC) platform that seamlessly integrates core banking systems such as Jack Henry Silverlake, Symitar, CIF2020, and Synergy, as well as thousands of other software. Using pre-built connectors and intuitive automation recipes, Workato empowers banks to unify fragmented systems, automate complex workflows, and rapidly deploy secure APIs to support digital initiatives.

Unlike traditional approaches relying on extensive custom coding, Workato offers a modular, plug-and-play solution enabling banks and credit unions to quickly implement and scale digital transformations. This flexibility not only speeds up implementation but also significantly reduces costs and enhances system reliability.

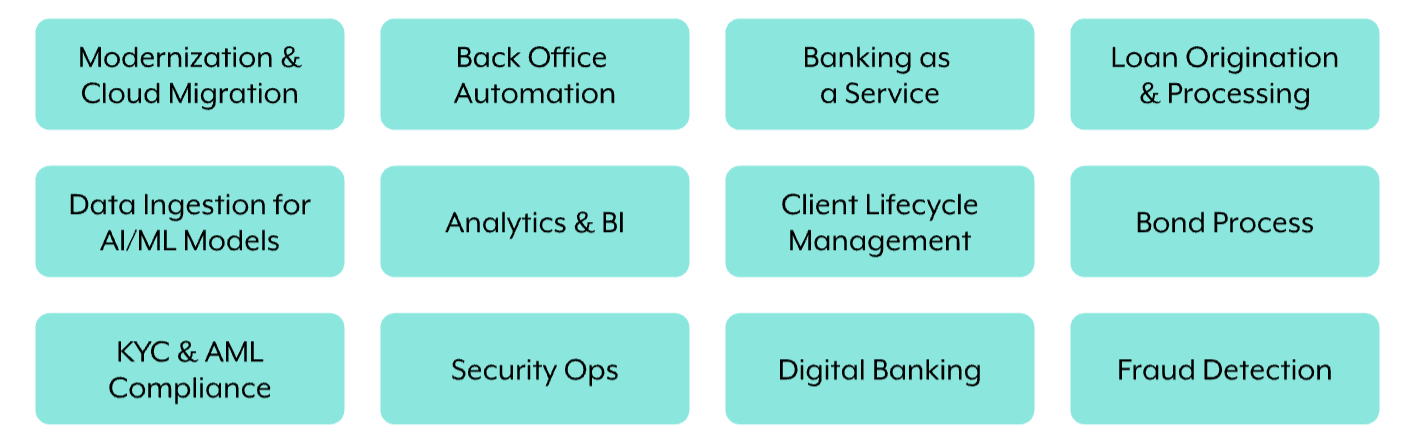

Here’s how Workato transforms traditional banking:

- Accelerated Processes: API People’s research found Workato accelerates core financial processes by over 80%, dramatically enhancing agility.

- Cost Efficiency: Gartner notes a 70% average cost reduction for banks implementing end-to-end back-office automation with Workato.

- Revenue Growth: According to Ernst & Young, modernizing legacy systems can increase revenue by as much as 10%.

- Enhanced Compliance: Automation ensures consistency, reducing errors and significantly enhancing audit readiness and regulatory compliance.

The Secret Sauce: Workato and API People Partnership

A major factor in Workato’s success in the financial sector is its strategic partnership with API People, a team with deep financial services expertise. With over 180 years of combined industry experience, API People translates complex banking needs into actionable Workato solutions within days, dramatically reducing traditional development timelines.

“The secret to our success has been API People knowing Workato,” says the CIO of a regional bank. “Within 24 to 48 hours, they’ll have it mocked up in recipes. If I had to hire developers, it would have taken them months.”

Beyond Integration: A Foundation for the Future

Workato’s approach isn’t just about solving immediate integration issues—it establishes a scalable and adaptable foundation for future innovation. By enabling seamless integration of modern fintech solutions, real-time data analytics, and cloud-native services, financial institutions can continuously evolve and respond proactively to customer needs and market trends.

This foundational shift ensures that banks and credit unions are not only keeping pace but also leading the way in innovation, customer satisfaction, and operational excellence.

Embrace the Future with Confidence

Workato’s cloud-native, scalable approach enables banks to innovate swiftly, cut operational costs significantly, and stay ahead of the competitive curve. It’s no wonder financial leaders are increasingly turning to Workato to lead their institutions into a digitally transformed future.

Ready to move from firefighting to innovation? Schedule a demo today to learn more.