Banks and credit unions have faced limitations with legacy banking cores and point-to-point integrations to run their operations for decades. While great at providing consistent stability, these outdated solutions have caused their own share of problems: bottlenecked innovation cycles, fragile connections, and rising maintenance costs. Now, these same financial institutions, once happy to maintain the status quo, are searching for solutions to address their urgent need to modernize. Customers demand seamless digital experiences, regulators require faster and more transparent reporting, and fintech competitors are rapidly introducing new offerings.

In approaching these challenges, our advice would be to focus your efforts on cloud-native integration and automation with your core processes, two impactful strategies that unlock core data, streamline processes, and adopt scalable integration. This is an important step most miss, as according to Capgemini’s World Cloud Report, 91% of banks and insurers have initiated their cloud journey, but most have held off integrating their core applications with surrounding systems, leaving them unable to realize full business value. However, with cloud integration and automation, financial institutions (FIs) can ensure they achieve full business value and drive accelerated innovation for their customers.

Why Legacy Architectures Hold Banks Back

Point-to-Point Integrations Are Limiting

Many institutions still rely on point-to-point integrations to connect their core and surrounding systems. This reliance often exists not by choice, but because core systems historically lacked productized connectors. While functional, these custom connections create brittle and complex environments. When a connection breaks, it can disrupt essential banking processes such as lending, deposits, or compliance workflows. Emerging solutions like Workato’s prebuilt connectors to core systems such as Jack Henry SilverLake, CIF2020, Symitar, and Synergy are beginning to offer banks more flexible options.

Vendor Lock-In

Core vendors frequently bundle their own fintech applications with middleware solutions. While convenient in the short term, this approach locks institutions into proprietary interfaces, limiting long-term flexibility. Access to data can be restricted or delayed, making it difficult to deliver new customer-facing services.

Costly Manual Processes

Manual, low-value processes that still require human intervention create significant operational inefficiencies. For example, a change of address request can trigger multiple manual updates across systems, consuming staff time and increasing the risk of errors. The result is that institutions spend more resources maintaining legacy systems than driving innovation and revenue.

The Case for Cloud Integration

For banks and credit unions, the real challenge is integrating systems so they work together seamlessly. Legacy cores will remain central to daily operations, but surrounding systems such as CRMs, data warehouses, and payment platforms must integrate with the banking core, regardless of whether they are on-premises or cloud-based, to deliver scale, agility, and innovation. A well-planned cloud integration strategy gives financial institutions the flexibility to modernize incrementally, reduce risk, and lay the groundwork for advanced capabilities like real-time analytics, AI-driven services, and seamless digital customer experiences.

Elasticity and Scale

Cloud platforms allow financial institutions to scale compute and storage resources on demand. This flexibility is critical for spikes in transaction volumes, seasonal lending surges, or stress testing. In fact, 87% of financial firms say that cloud technology enables faster innovation in service delivery, highlighting how integration across systems drives measurable value.

Security and Compliance

Leading cloud providers invest heavily in regulatory compliance, encryption, and monitoring capabilities that surpass many on-premises environments. By leveraging these controls, banks and credit unions can reduce the overhead of managing security frameworks internally.

Foundation for Innovation

Perhaps most importantly, cloud adoption provides the foundation for advanced services: real-time data analytics, AI-driven fraud detection, and open banking APIs. Without integrating core systems with cloud-based applications and data platforms, FIs will struggle to keep pace. A recent study conducted by EY found that banks using advanced cloud-based engagement tools achieved a 15% increase in revenue, demonstrating the link between cloud and growth.

Hybrid Path

Cloud integration is not an all-or-nothing exercise. Many banks take a hybrid approach, keeping the core on-premises while integrating it with cloud-based systems such as CRM, ERP, and data warehouses. This reduces risk while enabling incremental modernization.

The Role of Automation in Financial Modernization

Cloud alone is not enough. Automation ensures that systems deliver real business value.

Business Process Automation

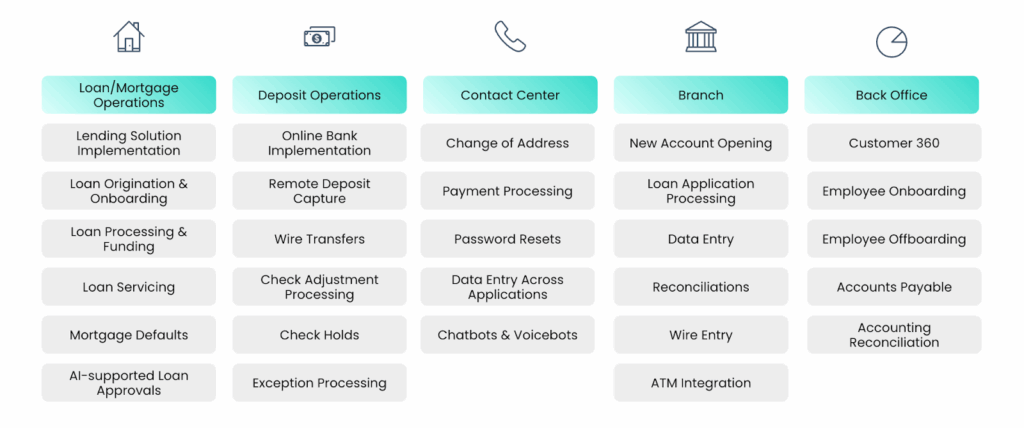

Workflows such as loan origination, payment processing, and reconciliations are ripe for automation. By replacing manual data entry with automated recipes, FIs reduce errors and cut cycle times dramatically.

Compliance and Risk Reduction

Automated compliance workflows can significantly reduce related costs. This includes streamlining KYC/AML checks, audit reporting, and regulatory submissions.

Unlocking the Banking Core

At the heart of modernization is the ability to unlock the banking core. The core remains the system of record, but access to its data is often constrained by vendor interfaces. A modern integration and automation platform can bridge this gap:

Reusable Connectivity: Instead of building one-off connections, reusable connectors provide rapid access to cores such as Fiserv DNA, FIS Horizon, and Jack Henry SilverLake.

Composable Architecture: FIs can connect the core to cloud applications like Salesforce, Workday, or Snowflake without brittle point-to-point dependencies.

Coexistence with Legacy: The Workato platform supports existing integrations while gradually replacing them over time.

Unlocking the core is not about replacing it. It is about extending its value through modern interfaces.

Why Workato for Banking Automation

Modernization isn’t just about moving to the cloud—it’s about unlocking your core systems so they work seamlessly with the tools your teams and customers rely on. That’s where Workato comes in.

- Faster connectivity: Prebuilt connectors to leading cores (Jack Henry SilverLake, CIF2020, Symitar, and Synergy) dramatically shorten project timelines.

- Governance and scale: A cloud-native platform designed with enterprise security and compliance in mind, giving CIOs and risk teams confidence.

- Automation-first: Beyond integration, Workato embeds automation directly into workflows—so a change of address, loan onboarding, or compliance report can run end-to-end without manual intervention.

- Partner expertise: Together with API People, Workato brings deep core-banking expertise and accelerators to ensure institutions see measurable outcomes, not just integrations.

The result: lower operational costs, faster innovation, and the ability to modernize incrementally—without ripping and replacing the core.

A Practical Path to Modernization

Institutions that succeed with cloud and automation follow a staged approach:

Identify High-Impact Use Cases: Start with processes that deliver immediate ROI, such as account opening, loan onboarding, or compliance reporting. These are common “automation candidates” that quickly demonstrate value.

Establish Core Connectivity: Implement prebuilt connectors to your specific core. This can reduce project timelines and lay the foundation for all subsequent automations.

Automate Business Processes: Deploy accelerators and recipes that handle routine financial workflows, cutting costs and error rates.

Empower Business Users: Provide Workbots and low-code interfaces so non-technical staff can trigger automations within familiar tools like Teams or Slack.

Expand Incrementally: Start with one or two high-value automations and expand into adjacent processes. This “land and expand” strategy helps mitigate risk while steadily transforming operations.

Modernization is an Incremental Process

Financial institutions that wait to modernize face rising costs, shrinking margins, and competitive pressure from digital-first players. While legacy cores will remain in place, their value is only unlocked when surrounding systems are integrated and automated. Modernization is not an all-or-nothing project. A staged, integration-first approach allows institutions to reduce risk, unlock efficiency gains, and create a foundation for innovation.

The banks and credit unions that begin today will reduce operational costs, accelerate time to value, and position themselves for long-term growth. Those who wait will find the gap increasingly difficult to close.

Explore how Workato helps banks modernize core connectivity and automation here.