ASX-listed fintech leader Novatti supports businesses across Australia and New Zealand with an award-winning suite of flexible payment solutions — from domestic payment acceptance and card issuing to Asian digital wallets and cross-border payments. But they faced a longstanding problem plaguing the entire financial services industry: slow, fragmented merchant onboarding that can drag on for months.

Mark Healy, CEO, led the shift toward a unified, customer-focused experience. His mandate was simple to describe yet difficult to achieve: unify product lines across four independent business units, each with separate onboarding requirements, systems, and approaches. His goal? To build a scalable process that wouldn’t buckle under growth.

“Even with 10x or 100x the customers we have now, it should be exactly the same effort,” Mark explains.

The Onboarding Labyrinth

Studies show that onboarding friction drives over 1 in 4 banking customers to abandon the process mid-stream. Even highly digitised sectors like fintech, report drop-off rates as high as 88%.

Novatti’s challenges mirrored industry-wide pain points:

- Fragmented customer experiences across business units: Customers engaging with different Novatti payment solutions could experience variation in onboarding processes, as different products were supported by different onboarding flows.

- Repetitive verification tested patience: Multiple risk and compliance tools created redundant verification steps. Validated customers returning for additional services three months later were often put through a separate verification process, impacting customers’ cross sale experience.

- Document chaos: The sales team had to log in to different Know Your Customer (KYC) platforms to manually chase emails.

Orchestrating 15 Systems into One Seamless Flow

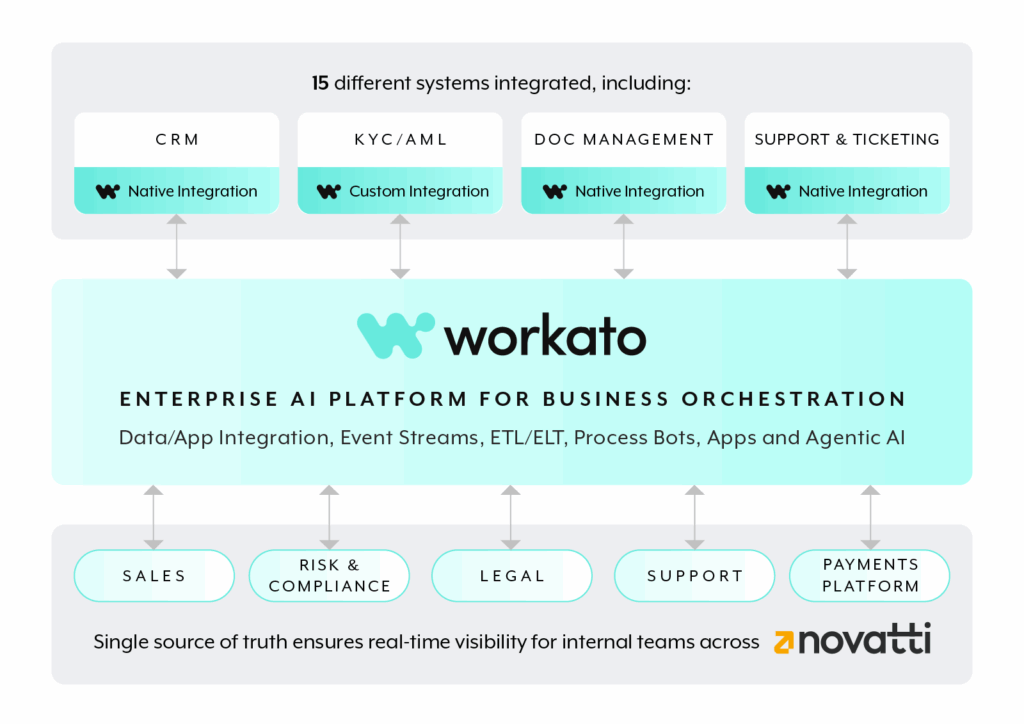

In the theme of simplifying life, Nathan and team removed disparate KYC systems, and the RegTech that came with it. The solution integrates 15 different systems, namely the CRM platform, KYC/AML platform, Document Management platform and support and ticketing platform:

The reimagined merchant onboarding process is tightly coupled with Novatti’s existing workflow which resides in legacy systems:

- Qualification: Workato automatically initiates KYC/AML verification when deals progress in the CRM, triggering identity verification requests to customers.

- Application: Upon approval, Workato synchronises verification results across systems and routes customer information to sales teams for pricing review and management sign-off.

- Proposals: Workato dynamically generates customer agreements from deal data and manages approval notifications and status tracking.

- Agreements: Workato orchestrates document signing workflows, provides real-time visibility to sales teams, and automatically stores completed agreements.

- Compliance Checks: Workato coordinates parallel risk review processes and creates provisioning tickets with relevant customer information, managing exce+ption handling when needed.

- Onboarding: Upon completion, Workato updates all systems with final account details and archives the deal from active pipelines.

From Months to < 5 Minutes

Novatti tracks performance using Workato Apps’ analytics dashboard. The results speak clearly:

Mark and his team to track the impact of their reimagined process, using the Workato Apps analytics dashboard:

- >99.9% time saving, lower overheads: What took months now takes under 5 minutes, even when deploying 7 different systems for a single customer. Customers are notified when their account is ready, with information on what payment methods are supported, and how they can get assistance. This removes overheads from internal operations and support teams, making it easier and faster to bring on customers.

- Deals progress proactively: Salespeople do not need to keep remembering to follow up at every step – they can focus on supporting new and existing customers. Workato keeps deals moving forward. It proactively prompts, nudges, emails and notifies other teams at every step of the way, such as triggering the risk team and then assigning settlement delays.

- Frictionless customer experience: From signup verification to ready contracts landing in inboxes, customers experience one smooth journey. Human oversight remains, but processes that took weeks now complete in minutes. Customers are also issued a Unique Novatti Identifier which links backend systems to all platforms and payment services, without having to manage multiple IDs.

- Engineering capacity unlocked: Engineers now have more time to focus on product innovation and customer value instead of maintaining integrations. Subject matter experts manage business-critical workflows directly.

- Unified visibility: The CRM becomes the single source of truth. Salespeople see real-time document activity. Signed agreements trigger instant notifications. Legal documents store centrally for easy retrieval.

Verification efficiency: Novatti verifies the customer’s organisation at first contact, before getting into the specifics of the product requested. Additional product information gets collected later without repeating verification steps.

Raising the Bar in Fintech

This transformation goes beyond Novatti’s internal efficiency gains. The financial sector faces mounting pressure to compete with digital-first alternatives where frictionless onboarding sets the standard.

By pioneering faster, compliance-friendly onboarding, Novatti is raising the bar for how Australian fintechs, banks, and payment providers approach customer acquisition. The message is clear: orchestration isn’t optional – it’s the foundation of competitive advantage.

Ready to transform your onboarding process? Explore Workato’s integration solutions or connect with our team to discuss your automation journey.