Why Banks Can’t Skip the Foundation

From fraud detection to personalized financial advice, financial institutions (FIs) are betting big on artificial intelligence to streamline operations and unlock new growth. But as AI evolves into its next frontier, agentic AI, where autonomous systems don’t just analyze but act, banks face a sobering reality: most are not ready.

Legacy cores, fragmented systems, and siloed data leave AI agents blind and brittle. Without the ability to orchestrate actions securely across applications, even the smartest large language models collapse under enterprise complexity. This is why the future of AI in banking doesn’t start with the model, it starts with orchestration.

The Integration Crisis in Banking

According to McKinsey research, 80% of AI projects never materially impact the bottom line. Why? While banks are experimenting with machine learning, their foundations are fractured. Core banking platforms remain the system of record, but essential tools such as CRMs, loan origination, payments, compliance, and fraud systems operate in isolation.

This creates what we call the AI Integration Crisis: AI can’t scale if it can’t access unified, real-time data or act consistently across systems. For banks and credit unions, this isn’t a theoretical problem. It shows up as:

- Slow innovation cycles: Months to integrate a new fintech partner or launch a digital product.

- Manual bottlenecks: Human-intensive processes for onboarding, compliance checks, and risk monitoring.

- Regulatory risk: Inconsistent data and patchwork integrations undermine auditability.

Bank leaders know this challenge firsthand. CIOs often describe the frustration of seeing AI pilots succeed in the lab but fail in production because their systems can’t talk to each other. Risk officers worry about fractured compliance processes that make audits painful and error-prone. Business teams get stuck waiting months to onboard a new fintech partner or launch a digital product.

Agentic AI demands something different: a secure, governed layer that unifies data, automates workflows, and enables agents to act in real time.

What Agentic Orchestration Means for Banks

Think of agentic AI as a team of digital co-workers. One agent monitors payment activity, another evaluates loan risk, and a third handles compliance reporting. Each has value on its own. But orchestrated together, they can anticipate issues, collaborate across systems, and execute end-to-end processes autonomously.

This is the essence of agentic orchestration, coordinating multiple intelligent agents across fragmented systems to deliver outcomes no single agent could achieve alone.

For banks, orchestration changes the game by enabling:

- Proactive risk management: Detect fraud, freeze accounts, and notify customers in seconds.

- Frictionless customer journeys: Automate onboarding across KYC, CRM, and core banking with no swivel-chairing.

- Real-time decisioning: Move from daily batch compliance checks to continuous monitoring.

- Revenue acceleration: Orchestrate personalized offers, cross-sells, and upsells directly into digital channels.

Why Orchestration Must Come Before the Model

CIOs often start their AI strategy with model selection: Which LLM is most accurate? Which agent framework is most flexible? But this approach often fails.

Without orchestration, the best model still fails in production. It lacks context, access, and governance. For example:

- A fraud detection model flags an anomaly, but can’t freeze the account because no integration exists.

- A customer service agent generates an answer, but can’t log the interaction into the CRM.

- A compliance monitor detects a risky transaction but can’t trigger an investigation workflow.

Orchestration bridges these gaps. It connects agents to enterprise systems, governs their actions, and ensures that AI outcomes are consistent, auditable, and scalable. For banks, it’s the difference between pilot projects that stall and AI programs that transform operations.

Workato ONE: The Orchestration Layer for Banking

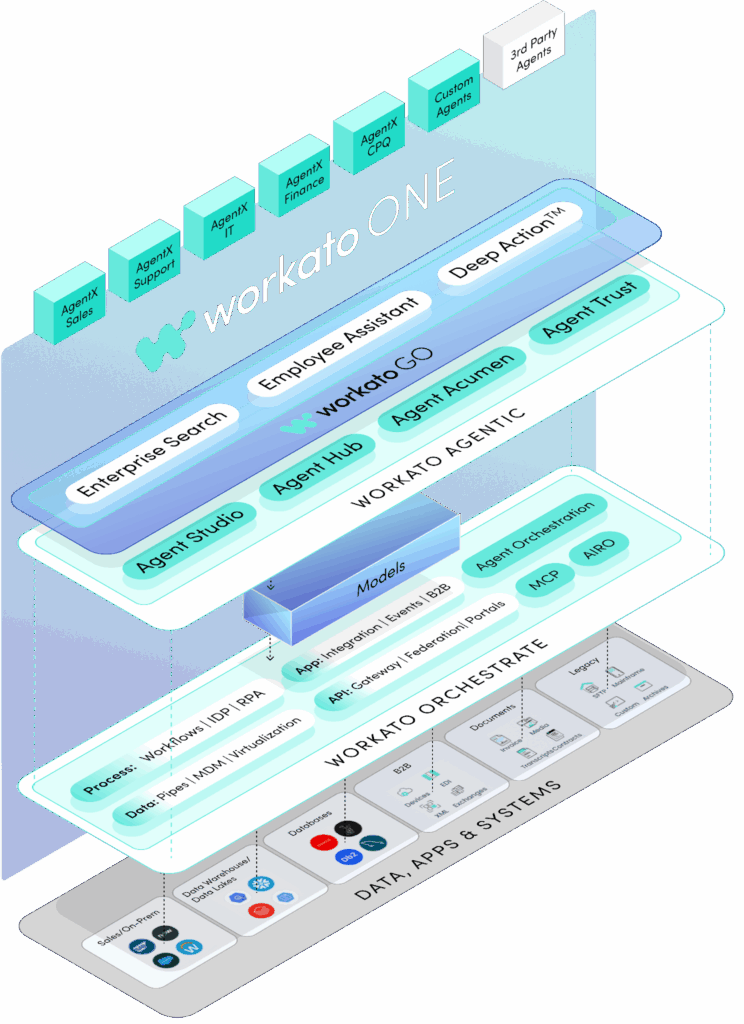

This is where Workato ONE comes in. As the enterprise orchestration platform, Workato unifies integration, automation, APIs, and data into a single layer purpose-built for AI readiness.

For banks and credit unions, Workato delivers:

- Low-code orchestration that empowers IT and business teams to automate loan origination, onboarding, and compliance workflows in days, not months.

- Governance and security to meet strict regulatory requirements, ensuring every AI action is logged, auditable, and controlled.

- Scalability that enables banks to pilot agentic use cases and expand enterprise-wide without ripping and replacing core systems.

- Pre-built connectors for legacy cores like Jack Henry Silverlake, Symitar, CIF2020, and Synergy.

Scaling AI Agents with Orchestration

Even when banks deploy agents successfully, most struggle to scale them. Each agent is often built as a point solution, hardwired into one workflow. That doesn’t scale to the hundreds of use cases banks need.

Workato solves this with modular orchestration. Agents become building blocks, composable, reusable, and orchestrated through a single platform. This reusability is key. Without it, AI projects remain siloed experiments. With it, banks unlock compounding value.

Real Outcomes for Banks and Credit Unions

Workato’s orchestration platform is already delivering measurable results for financial institutions:

- 80% faster core processes: Accelerated loan origination, onboarding, and compliance checks.

- 70% lower operating costs: By replacing manual processes with automation and orchestration.

- 10% revenue lift: Through modernization of legacy systems and faster product launches.

- Enhanced compliance: Automated audit trails and consistent execution across systems.

These outcomes show what’s possible when orchestration becomes the foundation for AI readiness—banks move faster, operate leaner, and strengthen compliance while unlocking new revenue streams.

And thanks to Workato’s partnership with API People, banks get industry-specific recipes built in days, not months, helping IT teams move from firefighting to innovating.

The Path Forward: Orchestrate First, Then Scale AI

For banks, the question isn’t whether to adopt AI. It’s how to do it responsibly, scalably, and profitably. The answer lies in orchestration.

By laying the foundation with Workato ONE, banks can:

- Break free from legacy bottlenecks.

- Govern AI safely and securely.

- Scale agents across hundreds of use cases.

- Deliver new levels of customer experience, efficiency, and growth.

Agentic AI will define the next era of financial services. But only the banks that orchestrate first will be ready to lead it.

Ready to explore orchestration for your AI journey? Schedule a demo with Workato and see how you can build a foundation for agentic AI in banking.